The Debt Snowball Method Explained (Infographic)

The debt snowball method is a popular debt reduction strategy. In this post, we explore how this method works, in four simple steps.

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support! Graphics and creative material for advertised products belong to the original creator.

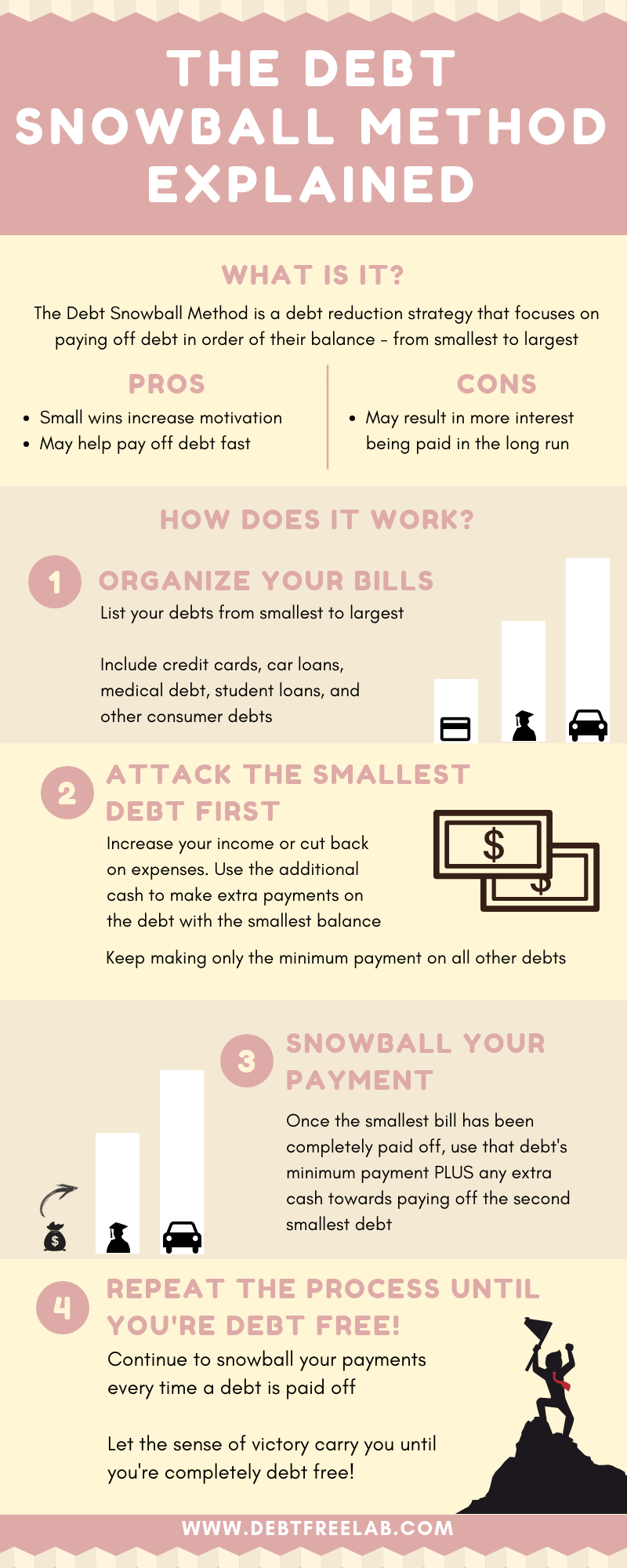

The debt snowball method is a method used to pay off debt.

Unlike other methods that may focus on paying off debt according to their interest rate or other factors, this method focuses on paying off debt in order of each account’s overall balance, from smallest to largest.

The theory behind this method is that the small wins at the beginning of the process will provide motivation and momentum to continue tackling even the largest, most difficult debts.

Related Posts

The Debt Avalanche Method Explained in 4 Easy Steps

3 Reasons Why You’re Still in Debt (& How to Fix it)

The Debt Avalanche Explained (With Infographic)

Here’s an infographic of how the debt snowball method works:

Although snowballing your debt may not make much sense mathematically speaking, I can tell you from personal experience that the debt snowball method works!

Resources

If you want to give this method a try, a great resource is the Debt Snowball Budget printable.

It’s easy to use, comes with lots of instructions, and will keep you organized on your journey to become debt free! Get it here:

If you are excel savvy, another great resource to use is the Debt Snowball Excel Calculator.

This tool automatically calculates the payoff date with a few inputs. Compatible with Google sheets, this Debt Snowball Excel Calculator is versatile and easy to use.

With the debt snowball method, every time you pay off a debt, even if it’s small, you feel a sense of victory and pride.

This sense of accomplishment works to motivate you to continue the process until you’re completely debt free.

Want to learn more about how I used the debt snowball method to get out of debt? Download my free Quick Start Guide to Paying Off Debt.

In this short eBook I reveal the common pitfalls that hold people back from paying off debt and how to fix it, the step by step blueprint I used to pay off over $50K of debt on one income, and much more!

Click here to download the guide completely free, and get on the road to living debt free once and for all!

Still not convinced the debt snowball method is right for you?

To find out what the best method for you is, check out the Pay Off Debt app. With the Pay Off Debt App you get to see what works best for you based on your exact debt situation and selections.

Choose from the debt snowball method, the debt avalanche, or something else entirely.

Would you love to watch your debt go down and know exactly when you could be debt free? Then the Pay Off Debt app is for you!

Do you have a debt snowball success story? Share in the comments below!