About

Hi! I’m Karen, and I’d like to welcome you to Debt Free Lab!

A little bit about me:

I’m a thirty something who loves to travel and explore new places. I also love to read and and go to the movies.

I live in the US with my husband and son.

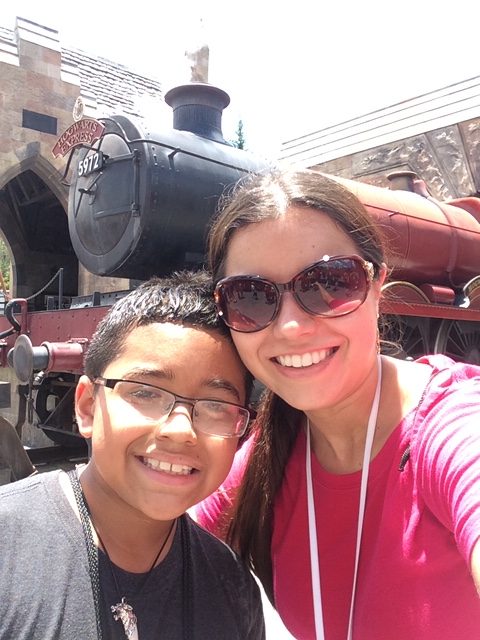

Our favorite pastimes are watching Star Trek and visiting theme parks.

I’d have to say our favorite theme park is Universal Studios!

Anyway, off to more serious topics 🙂

Why I Created Debt Free Lab

I created Debt Free Lab to help others save money, get out of debt and achieve their financial goals.

I’m passionate about helping everyday people achieve financial success.

Here’s why.

I first got married when I was 18 years old (Crazy, I know). Back then I was naive, overly optimistic and yeah, I didn’t know anything about money.

Throughout the following several years my then-husband and I made a lot of very bad financial decisions.

Keeping up with the Joneses

To anybody looking in from the outside it would probably look like we were living the American dream.

We both had good paying jobs (making a combined $100K+ a year). There were three cars and a motorcycle sitting on our driveway. We took a few vacations a year. We hosted weekly parties for our friends at our expense, and lived in a pretty comfortable 5-bedroom house.

Now, I can’t say it wasn’t fun, but the truth is… it was all a lie.

One More Statistic

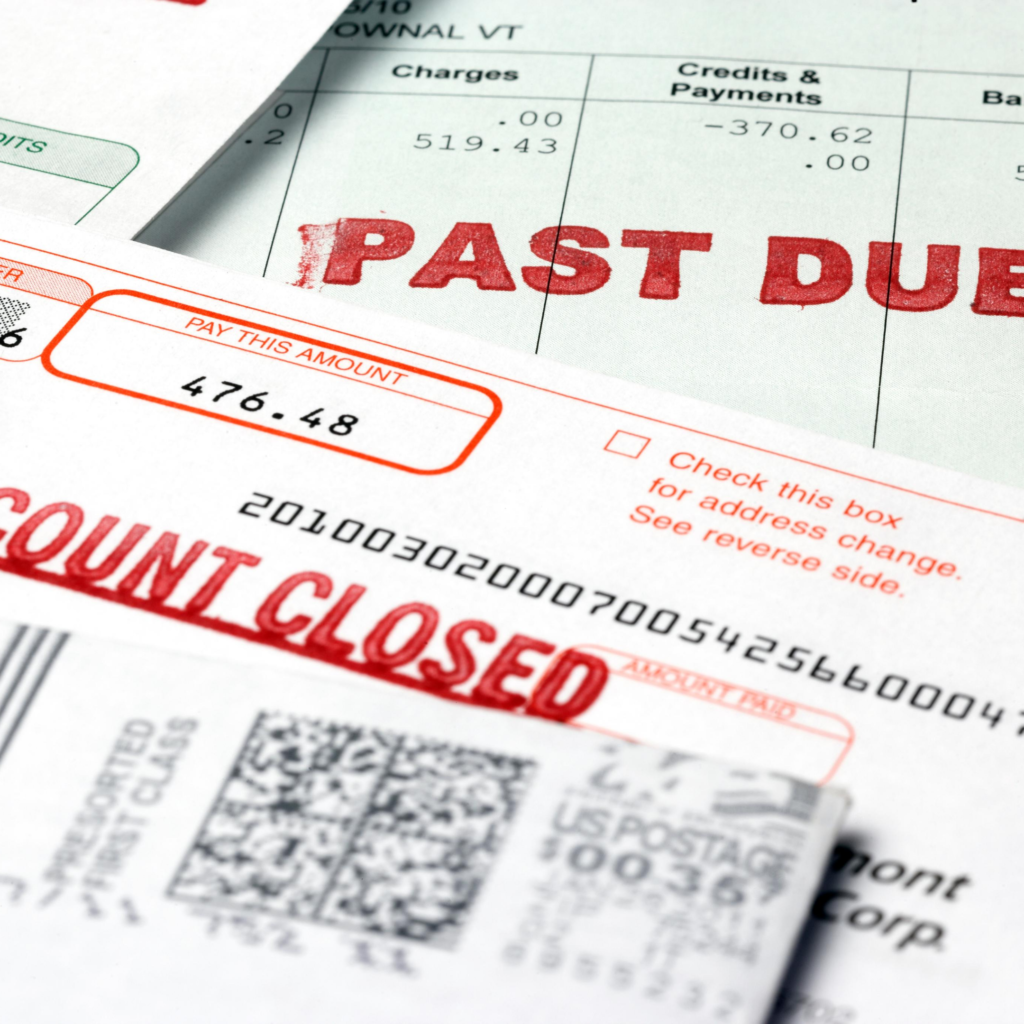

Behind the scenes, all our credit cards were maxed out, we were living paycheck to paycheck. We were getting payday advances trying to afford a lifestyle that was well beyond our means.

At some point, we even started our own business thinking it would be our ticket to being debt-free but, just like in our personal finances, we were taking out more than what we were bringing in.

Naturally, the company failed and closed within a year.

Sadly, we had just become one more failed business statistic, and that was not the only thing we lost.

Eventually, the house was foreclosed on, the cars were repossessed, and our credits were ruined.

On one particular low point, our account was so overdrawn that my entire paycheck for the previous two weeks of work went just to pay overdraft fees at the bank and it didn’t even cover it all

When it Rains it Pours

On top of all that, in 2006 and 2007 I went through a complicated pregnancy and delivery.

It forced me to be in the hospital more times than I can count, cutting my income significantly and adding thousands upon thousands to our already large debt.

The financial stress proved to be too much and our marriage did not survive.

We finalized our divorce in 2009 and I found myself a young single mom of a baby boy.

Throughout my marriage, we incurred most of the debt on my credit since I had a better credit score than my ex-spouse. This ended up costing me dearly!

Since I couldn’t afford a good lawyer that would fight for the debt to be split fairly, the judge ruled that I had to pay for most of it.

I walked away from my marriage with zero in the bank, a 515 credit score, and owing over $50K.

Down in the Dumps

For about three years I had to get healthcare from the local county clinic, use food stamps, and share a small one-bedroom apartment with my son.

That’s all I could afford, and frankly, I spent most of those years throwing daily pity parties for myself.

I was angry, disappointed in myself, and I just couldn’t see a way out.

Then one day, I got really sick. My stomach hurt so much that I couldn’t even walk.

A friend of mine who was a nurse said I should go to the hospital but I refused only because I knew it would mean another bill I couldn’t pay.

In the end, I ended up going, and it became my turning point.

At that moment, I finally decided that enough was enough.

A Turning Point

When I got back from the hospital, I made it a point to clean up my finances.

So I made a list of all my debt and of all my income.

For the next couple of months, I tracked and categorized my expenses.

When I had a clear picture of my financial situation, I started tackling one thing at a time.

I became a savvy consumer, I fixed my credit, I stopped avoiding my creditors and started eliminating my debts.

Little by little, I became financially free!

It’s been a few years since it all started, and I can finally say I feel pretty good about my financial situation.

I have built up my savings and retirement accounts, I have provided for my son’s higher education, and I no longer have a mild anxiety attack every time the phone rings… Goodbye collectors!

I have an excellent credit score, and most importantly, I am Debt Free and financially secure!

Today, my mission is to help others save money, get out of the debt cycle, and find the freedom I’ve found.

If I can help just one person achieve their financial goals and learn from my mistakes, all those sleepless, worry-filled nights will have been worth it.

Feel free to check out my articles, contact me, or subscribe to my newsletter to receive tips and resources right to your inbox.

Once again,

Thank you for visiting Debt Free Lab!