3 Reasons Why You’re Still in Debt and How to Fix It

If you’ve ever tried to get rid of debt but made little progress, chances are you’ve been addressing the symptoms and not the root cause. Here’s 5 reasons why may still be in debt, and how to fix it!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

Trying to get rid of debt by addressing maxed out credit cards or past due bills may prove ineffective, as these are symptoms of a problem, not the cause itself.

If you want to get rid of debt once and for all, you need to focus on the real root of the problem.

What’s causing you to max out your cards or add to your debt in the first place?

Today I’m sharing 5 common reasons that may be keeping you in debt, and how to fix it!

You’re Not Fully Committed to Getting rid of Debt

Getting out of debt is tough. In fact, many people who are now debt-free would tell you that getting out of debt is one of the most difficult challenges they’ve ever faced in their lives.

Debt can sometimes seem insurmountable. This is why many of us start down a debt pay-off journey half-heartedly.

The obstacle may seem too large!

It feels easier to not give it your all than to be 100% in and risk failure.

The Fix:

Recognize that unless you’re fully committed to paying off your debt, it’s unlikely that you’ll make any real progress. To find your motivation, find out why you want to get rid of debt.

Paying off debt solely for the purpose of paying it off is not really inspiring. Spend some time doing some soul-searching and answer the following questions:

- How will paying off debt improve my life?

- What will my days look like once I’m out of debt?

- How will I feel once I’m debt free?

- What will I be able to do that I can’t do now because of my debt?

- How will my family be impacted by me paying off my debt?

Practice visualizing your life after debt. Sometimes, we allow debt to define us. When we’ve spent years in debt, it starts to get difficult to picture a life where debt doesn’t exist.

Picturing what that looks like in detail can help you find the motivation to get 100% committed.

Having the right tools is also key to keeping that commitment long term. Something that’s really helped me is to have a visual aid handy.

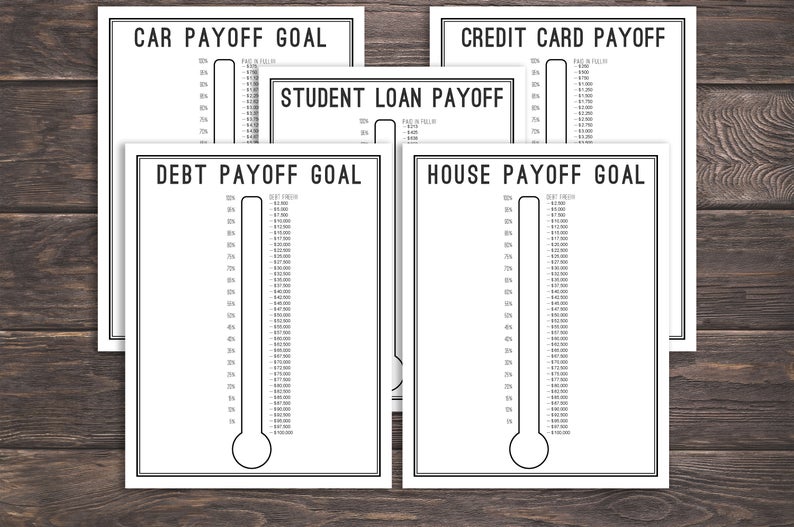

If you want to keep it light and fun, go with a Debt Thermometer Tracker. It’s easy to customize and fun to fill in.

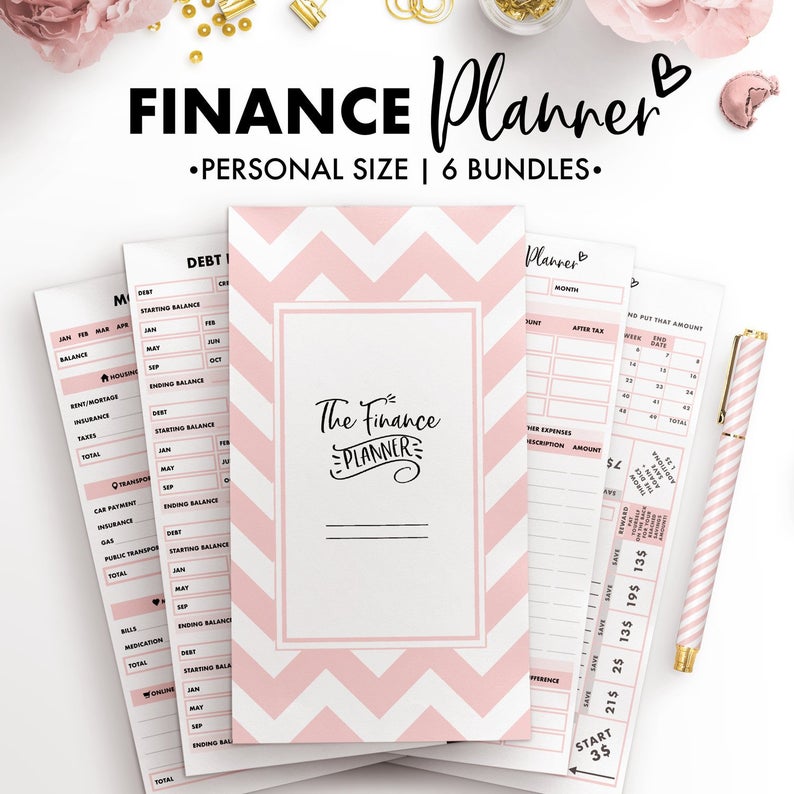

If you want a more in-depth tool, use the Ultimate Finance Planner Pack. This resource is jam-packer with tons of useful pages!

You’re Still Keeping up with the Joneses

We all have an innate desire to fit into “our pack” and to be on par with our peers.

Whether that’s your friends, your neighbors or your family members.

After all, nobody wants to hear that they’re the only one of their siblings who doesn’t have a house (or spouse for that matter) yet at the next family reunion.

Oftentimes, that outside pressure to “compete” with our peers can cause plenty of anxiety and feelings of inadequacy.

To compensate, we often try to keep up. We feel like we need to upgrade our wardrobe, car, or house, to be on par with everyone else.

This is a downward spiral that never ends well. I should know. In my early twenties, keeping up with the Joneses is exactly what I did.

In the end, it was me who ended up with a huge amount of debt that nobody was going to help me pay!

By the way, if you want to learn more about how I was able to get rid of massive debt despite many, many bad financial decisions, be sure to download my free eBook here. Learn the exact steps that helped me become debt free and how you can do it too!

The Fix:

Recognize that everyone is on a different path or place in their journey.

Accept that it’s ok to be where you are at this particular moment in time.

This is easier said than done, of course, but here’s some things you can do right now to start you on the right direction:

- Keep the pressure in check: Identify the people or situations that trigger that need to keep up, and limit your exposure to it. If it’s scrolling through social media or hanging out with certain friends, limit the time you devote to these activities.

- Combat negative thoughts: Our behavior is mainly dictated by our thoughts, which is why it’s important to keep any negative thoughts at bay.

If you find yourself thinking something along the lines of “I should have X by now” or “I’m not as wealthy as so and so”, recognize that while you may not be able to change your situation right this minute, you do have the power to change your thoughts.

This in turn will change the way you behave and help you create the life you truly want.

Next time the pressure to keep up comes around, don’t accept it! Speak positively to yourself instead, and be kind to yourself, accepting your current situation as momentary instead of permanent.

Related Posts

How to Get Serious About Paying Off Debt

5 Amazing Tools to Rule Your Money This Year

How to Buy Everything You Want and Not Owe Anything

You’re Not Saying “No” to Yourself

I like microwaves. They’re convenient, and it feels almost magical that you can make a meal in just a few minutes.

However, I believe that microwaves and their immediate results have spoiled us a bit. All around us, there’s a ton of conveniences that focus on delivering instant results.

Having been conditioned to having everything right now makes it difficult to wait for what we want.

One of the main reasons why people have a problem getting out of debt is not saying no to buying something they want, even if it’s not the right time to buy it.

The Fix:

If you have trouble postponing large purchases, practice with smaller items. Sometimes when I go to the supermarket I get tempted to buy things that are not on my list.

Even if I can buy them, I don’t, just so I can strengthen my self-control “muscle”.

Believe it or not, saying no to small dollar items can make it easier to say no to a larger purchase.

This can really impact your finances sometime down the road.

Other ways to stay out of financial trouble include:

- Creating a savings fund designated for what you want to buy and postpone the purchase until you’ve gathered all the money you need

- Not carrying your credit cards with you or using a cash envelope system

- Avoiding shopping malls and other places of commerce until you have enough money to purchase what you want

- Reassessing your financial priorities

- Getting clear on what you consider a need versus a want

- Evaluating if what you’re about to get is truly going to benefit you or bring you joy

I will be writing all about how that last point changed my spending habits for the better in an upcoming post. It happened after I stumbled upon a seemingly unlikely source of inspiration – a book about cleaning and organizing.

In The Life Changing Magic of Tidying Up, the author challenges her readers to ask themselves that very question as they pick up each item they own. Sadly, when I went through this exercise I didn’t find many items that made me feel joy, or anything at all for that matter.

Once I realized this, I started asking myself if an item would bring me joy before I bought it. As a result, my spending on material items has been significantly reduced!

Lastly, give yourself time to fully process the purchase decision you’re contemplating. If you feel like you have to buy something right here, right now, chances are you’ll be buying items you don’t need or really want just out of impulse.

Think it through. If I’m at the mall, for example, and I like something but I’m not sure if getting it is the right decision, I keep walking for a bit, and visit other stores.

If I later feel compelled enough to walk back to get it (and I can truly afford it), I do.

More often than not, I find the trek back too much of a hassle. To me this means I don’t really want the item as badly as I originally thought.

To summarize, getting out of debt is really difficult, but it can be done by addressing the root causes of the issue and not just the symptoms.

As you get truly committed to paying off your debt, leave aside toxic comparisons, and practice patience and self-control, you’ll be able to conquer your debt once and for all!

Are there any other reasons you feel have kept you in debt? Share them in the comments below!

Did you find this article useful? Please share it!

I thank you for this article. There are all kinds of debt payoff websites and articles, but reason-based ones are not as prominent. I find myself stuck in 1 & 3 for sure. While it may not be a big ticket item I’m buying, I find myself moving money from that saving bucket for that widget to pay for a decision I made earlier that day or a weekend night out. I do believe though that if I did decide to commit 100% to paying off the debt, the tendency to move money around would weed itself out as my… Read more »