5 Quick Tips to Budget and Save Money

If you dread the word “budget”, chances are it’s because you’ve tried to budget, unsuccessfully. Here’s 5 quick tips to successfully budget and save money!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

Ahhh budgeting – it evokes such fond memories doesn’t it? Most people dread the word “budget”, but here’s the truth:

A budget is nothing more than a piece of paper where you get to control your money so your money doesn’t control you.

When I first started to budget and save money, to be honest with you, I hated it!

But as time went on, it kept getting easier, to the point that I actually enjoy budgeting. Today, push fear aside and take a step in the right direction.

Look at your budget head on, and identify any areas that need improvement. These are the areas where you have the most opportunity to save money.

As a good starting point, here are five quick tips to successfully budget and save money:

Don’t Make it Too Strict

Your budget shouldn’t feel like a prison sentence!

Reduce your expenses gradually instead of overnight, so you can give yourself time to adjust.

In fact, many people blow their budget because of this one common mistake. They make their budgeting goal so unattainable that they easily give up because they know it’s a lost cause.

Instead, use your budget as a navigation tool to tell you where to go, and then get there by taking consistent steps.

For example, let’s say you want to bring down your grocery expenses to $400 a month, but based on your current spending, you’re at about $1,000.

Instead of changing your whole life overnight to meet this goal, try to reduce your grocery expenses to $800 for the first couple of months by making small changes to your existing routine.

Maybe go to the store less times a month, or try a different store altogether.

Once you’ve become comfortable with those changes, cut your spending again by another couple hundred bucks a month by making even more changes. Start using coupons if you don’t, or give yourself a spending limit for each of your trips to the supermarket.

If you give yourself time to adjust, you’ll have a better chance at success!

Plan for the Unexpected

A major cause for failed budgets is expenses that were not included in them or that were miscalculated.

To avoid this, track your expenses for a couple of months so you can have an accurate picture of where your money is going, and have some cash cushion for when an unexpected expense creeps in.

The easiest way to do this is with a budgeting app.

For a budgeting option on the go, you can try the Empower app.

Empower is one of the fastest-growing personal finance apps in the US, with 4.7 stars in the Apple app store and over 650,000 downloads to date.

It features painless budgeting, spend tracking and more. Get started with the Empower app today to have a host of personal finance tools in the palm of your hand!

I do have to say that there’s just something about putting things down on paper. Somehow, it can feel like you’re more in control than just using an app.

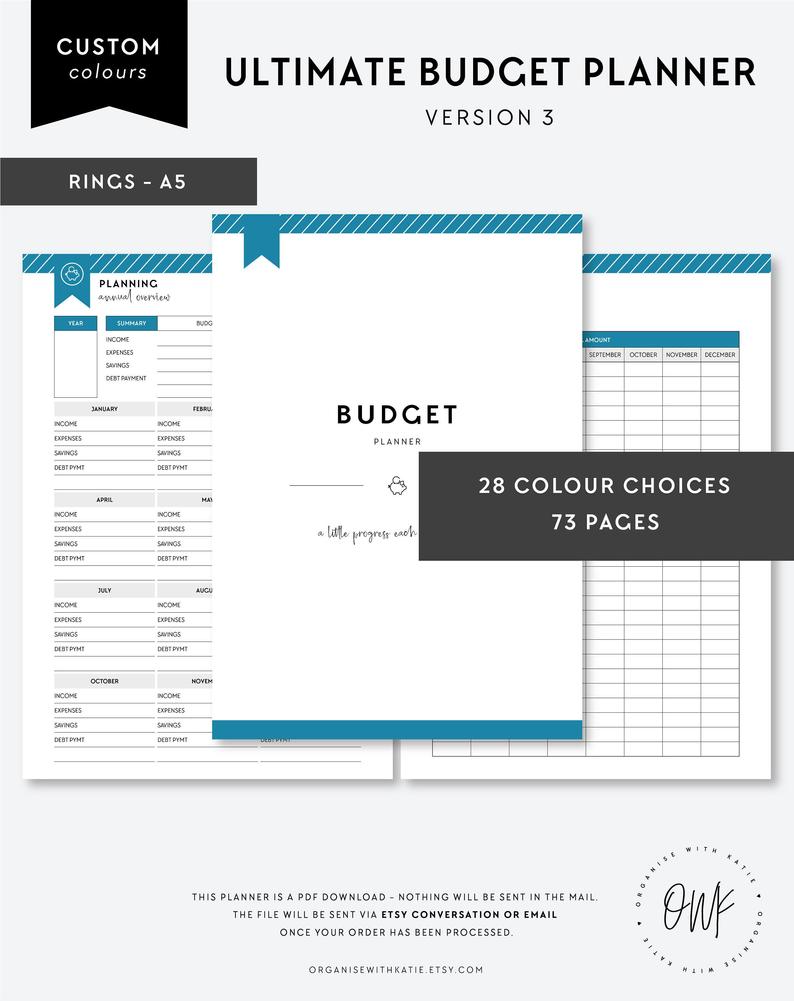

If you prefer to keep your budget in a physical format, I recommend The Ultimate Budget Planner.

With this printable, you can record your savings, expenses, debt payments and financial goals.

Get yours here!

Budget in Some Fun

Build a little wiggle room for fun into your budget. If it feels too rigid or restrictive, chances are, you won’t stick to it for long.

Think of it as one of those diets that call for removing all sugar or all – insert your favorite type of food here – You may be able to stick to it for a while, but your body will be fighting you every step of the way.

A better approach is that of moderation!

If you’re used to going out 5 times a month, cut it down to 4 at first, then to three, until you eventually get to a point where you can be comfortable with your spending in that area.

Reward Yourself

Rewarding yourself when you stick to your budget is important to keep you motivated.

However, don’t go too crazy and blow your savings away!

Keep it simple; it may be a night out (or in) with your friends, or ice cream with the kids, but set the reward beforehand and enjoy it fully, and without guilt, when you do reach your goal.

Related Posts:

6 Simple Hacks to Always Pay Your Bills on Time

Insomnia Can Derail Your Finances. Here’s How to Keep Them on Track

3 Quick Strategies to Achieve Your Financial Goals

Stick to Your Budget

Budgeting always requires some adjusting at the beginning, but don’t despair! Stick with it a little longer and you’ll see it becomes easier as you go.

As a final token of encouragement, let me assure you that you can have a successful budget. I know this.

How?

Because if I can budget and save money, anybody can.

I’ve been a total financial wreck, but budgeting got me out of debt and in a good financial position.

Although it may be difficult at the beginning, if you stick with it, budgeting can do the same for you!

Want to learn more?

Sign up to receive my FREE Quick Start Guide to Successful Budgeting.

Learn how I made my budget work for me, why budgets often fail to deliver real financial results and how to make sure yours is a total success!

What is a Successful Budget?

Now that you know how to make sure you don’t end up dreading your budget, let’s discuss how you will be able to know if your budget was successful or not.

A successful budget is more actionable than informational.

Your budget should have been able to tell you how much money you were gonna have at the end of the month after paying off all your bills and expenses. It should also have been fairly close to your ending bank balance.

If you thought you were gonna have $1,000 in your checking account at the end of the month but you really ended up with $35.78, your budget may need some tweaking.

This often happens because you underestimated your expenses. If this is the case, then go back through your bank statements for the past few months and see what you could have missed.

Did you have any personal loans you forgot to include the payment for? What about student loans? Make sure you’ve included all your debt repayments in your budget.

For step by step directions on how to create a successful budget every month, sign up to receive my FREE Quick Start Guide to Successful Budgeting. Not only does it come with a super awesome companion workbook, but I’ve also included a budgeting template you can use for each month of the year.

As you get more and more familiar with budgeting, you’ll be able to adjust your budget, AND your spending, to align with your financial goals.

What is your greatest challenge when it comes to budgeting? Be sure to share in the comments below!