9 Best Money Saving Challenges to Try Today

Are you looking for a clever way to motivate yourself to start saving money? Try any of these Money Savings Challenges and see your savings add up this year!

This post contains affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure. Thank you for your support! Graphics and creative material for the products listed below belong to the original authors and creators.

If you’ve ever tried saving extra money before, you know sometimes it can be really trying to stow away that extra dollar or two.

Whenever I’ve tried to build up my emergency fund, I’m often reminded of the piggy bank type jar the characters of the movie “Up” kept breaking every time an emergency came up. In the end, they were unable to save up enough spare change to achieve their dream of traveling together.

This is completely relatable, since saving money is often difficult for the majority of people. If you feel like you’re not making enough progress saving money, you’re in good company.

Why Is Saving Money So Difficult?

Saving money is difficult because it often requires us to make sacrifices we’re not willing to make.

After all, money is a limited resource, and every dollar saved has an opportunity cost – the loss of what you could have done with that dollar had you spent it instead.

Also, extra money is sometimes hard to come by. If you’re already living in a tight financial situation, it may seem difficult to “find” spare change to put into your piggy bank.

This is why it’s important to come up with clever ways to build some fun into money saving. This will keep you motivated and alert to any possibilities of saving money that maybe you wouldn’t have thought about otherwise.

This is where saving money challenges come in.

What Are Money Saving Challenges?

Money Saving Challenges are challenges that encourage you to save up a particular dollar amount within a specified period of time.

It can be a printable sheet or an excel or word document. It can contain stickers or illustrations, or just plainly state how much you should save when.

The format and presentation may vary, but what matters about a money saving challenge is that it can keep you motivated to save more money that you regularly would.

By giving you a goal, and presenting it in an exciting manner, a saving challenge can help you achieve your goal to save money.

If you want to make this the year you start saving money, or finally pad your savings account significantly, I’ve compiled a list of some clever and fun Money Saving Challenges that will challenge you and keep you motivated to save lots of money this year.

Let’s get started!

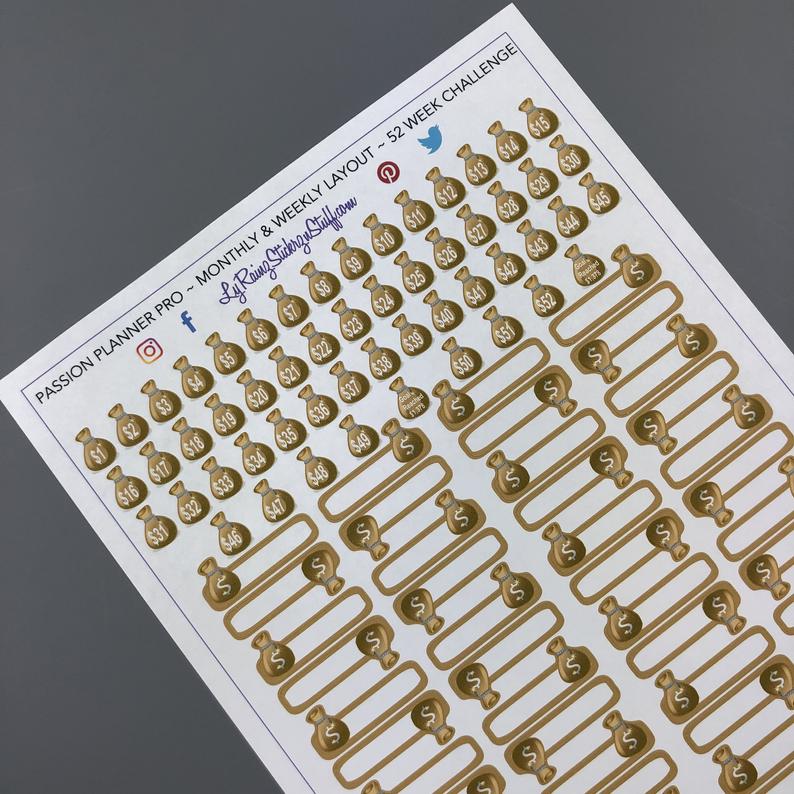

52-Week Sticker Money Saving Challenge

If you love stickers like I do, this 52-Week Money Savings Challenge is the perfect challenge for you to start saving money!

With medium-sized stickers, there’s no fumbling to get tiny stickers off the page, and they cover 52 weeks – a whole year of stickers!

Giving you the flexibility to save a different amount each week, this 52-Week Sticker Money Saving Challenge is a great way to motivate you to save a little each week.

At the end of the year, your savings would add up to $1,378! So if you want to start saving money, this fun money saving challenge is perfect!

52-Week $10000 Money Challenge

There are plenty of weekly saving money challenges, so if you’re up for saving more money, here’s a challenge for you. Want to stay motivated and on track to save over $10,000 in the span of one year? Then this 52-Week $10000 Money Challenge is the right one for you!

Saving $10,000 in a year is quite impressive in my opinion. Just think of everything you can do with that extra chunk of money.

You could put it towards your emergency fund, or even towards a downpayment to a house!

If you want to get serious about saving a large amount of money, give this 52-Week $10000 Money Challenge a try!

The 100 Envelope Challenge

This challenge is a bit more interactive than just having a printable that you fill out, which is why it’s a crowd favorite!

I personally love involving my son in this challenge. He gets really excited to participate in the process and handle real cash. I think it’s a good way to give kids some experience with saving and handling money.

What is the 100 envelope challenge?

The 100 envelope challenge is a money saving challenge where you have 100 physical envelopes, each labeled with a number from 1 to 100 on the outside. You keep the envelopes in a bag, binder, or folder.

Each week, you choose an envelope at random. Whatever number is written on the envelope is the amount of money you should put into savings for that particular day. So you place that amount of money into that envelope and set it aside.

By the end of the challenge, you will have accumulated a little over $5000.

Wand to give this challenge a go? Try this envelope challenge where you pick two envelopes a week. It’s a fun activity that you can even do as a family. The kids love this!

30-Day No Spend Challenge

Remember that opportunity cost we spoke about earlier?

One of the best ways to “find” extra money is to not spend it.

Do you want to challenge yourself to go a whole month without spending? Try this 30-Day No Spend Challenge!

This printable will keep the reason why you’re saving money in the forefront of your mind.

Aesthetically pleasing and easy to use, display it in a visible place and reach your goals faster with this 30-Day No Spend Challenge!

When I did my own no-spend challenge, I kept my printable on the refrigerator door. That way, it was visible to the entire family, and it was easy to point to whenever one of us felt like splurging on something.

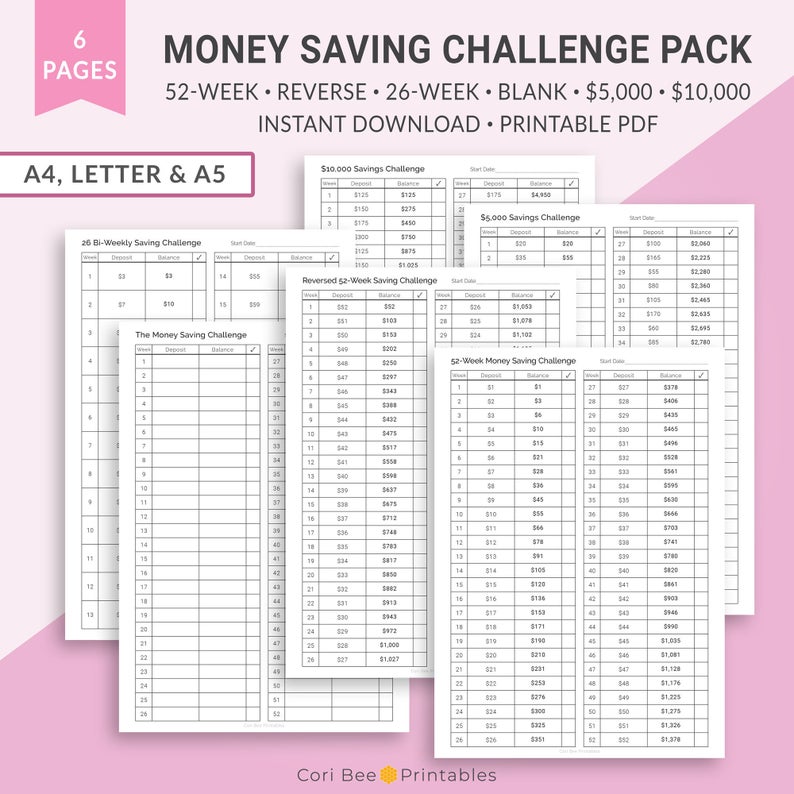

Money Savings Challenge Pack

If you want to mix things up, I recommend the Money Savings Challenge Pack.

It comes with a variety of challenges, including a 26 and a 52-Week Savings Challenge, as well as challenge for a specific dollar amount.

It even includes a blank Savings Challenge to allow you maximum flexibility to start saving money.

With a free printable guide and multiple sizes available, this Money Savings Challenge Pack truly fits any budget!

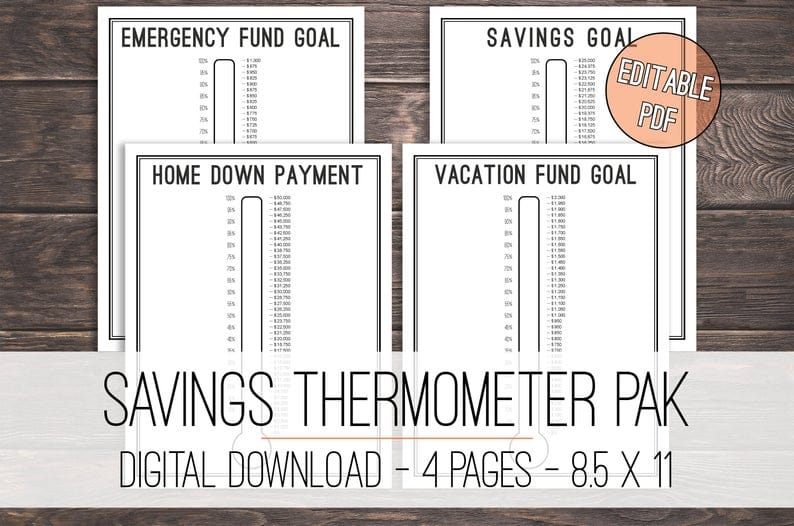

Savings Thermometer Tracker Printable

I love using thermometer printables. I think they’re really fun and they’ve always kept me motivated to start saving money. Normally, I post mine on the fridge and fill them in once a week.

This Savings Thermometer Pack comes with 4 different pages to help you save money towards a specific goal.

The pages are easily customizable to the amount you’d like to save, making this Savings Thermometer Pack a fun and simple way to help you set money aside!

Other Money Saving Challenges

Saving money is definitely a lot more fun when you’re using a printable or some type of visual aid. However, if you want to keep it simple, you can just challenge yourself to do one of the following:

The $5 Savings Challenge

The $5 savings challenge, sometimes referred to as the five dollar saved challenge, is a money saving challenge where you save every five dollar bill that you come across.

Say you go to the store or make a purchase somewhere and the change you receive includes a $5 bill. In this challenge, you would store that five dollar bill until a certain date. Let’s say you do this for a full quarter, or a full year even.

At the end of the period of time you decided to use for this challenge, you gather up all the five dollars saved and you deposit them into your savings account. Easy-peasy!

The Rounding Savings Challenge

The rounding savings challenge, or the penny savings challenge, is where you round up all the purchases for the day, and at the end of the day you transfer the sum to a savings account. For example:

Let’s say that today is Monday, and you paid your car insurance for $122.60, your water bill for $130.75, and you bought $68.20 in groceries.

At the end of the day, you would add up all the pennies you would need to round up all those amounts to the nearest dollar. In this example, the amount would be $1.45, so you would transfer that amount to your savings.

If you want to accelerate the savings process, you could also pick one or two days a week where you round up to the nearest five instead of just the nearest dollar.

Sinking Fund Savings Challenge

Another way to keep yourself motivated to save money, is to allocate it for a particular purpose.

Let’s say you want to go on vacation in 6 months and know it will cost you roughly $600. Then your challenge is to save $100 each month for the next six months in order to have the amount you need when you need it.

This is often called a sinking fund, and it’s a great way to ensure you don’t go into debt for a large purchase.

Related Posts:

5 Amazing Tools to Rule Your Money This Year

How an Emergency Fund can Avoid Financial Ruin

3 Quick Strategies to Achieve Your Financial Goals

Where To Keep Your Savings

Now that you’ve accumulated TONS of money with these money savings challenges, you will need to find a great place to keep it 😉

When I started saving money, I would just leave it in my checking account. This didn’t work that well because when different expenses came up, it was way too easy to just spend the money without a second thought. Eventually, this just made my savings deplete over time.

I felt like I was taking one step forward and two back!

There was a similar problem with keeping the money in a local savings account linked to the checking account, since I could just instantly access my savings with the click of a button.

This is why I recommend an online savings account. Not only do these accounts normally give you a higher interest rate, but they give you the best balance between accessibility and making you think twice before getting your hands on your savings.

Personally, I use CIT Online Bank. Their rates are a lot higher than regular banks, and they’ve been as high as almost 2%! Right now it’s not as high since the interest rates overall are so low, but it’s still a lot higher than what you can get at the local bank.

You can still link your CIT account with your local bank account for easy transfers to and from, but it takes a couple of days to actually get the money. This always gives me pause, and allows me to evaluate if I truly need to transfer the money.

To get your CIT account and start earning interest on your savings, check them out here!

Final Thoughts

If you want to start saving money, it can be really difficult sometimes.

That’s why I like to use tools such as visual aids and money saving challenges to keep me motivated.

These resources help me remember my goals when I feel discouraged, and help me get back on track when I’ve veered off course.

I hope they are as useful to you as they’ve been for me!

If you’d like to learn more about my journey to financial freedom, and how I was able to pay off over $50K of debt as a single mom living on one income, you can check out my Free Guide to Mastering Money here!

What has been your favorite money saving challenge? Why? Please let us know in the comments below!

Great challenge compilation! I’m a Dave Ramsey fan so i got happy seeing “envelopes”

Thanks Caroline, I used the cash envelope system when I started my journey to become debt free and it definitely helped me!