How an Emergency Savings Fund Can Avoid Financial Ruin

Financial disaster can affect anyone at any moment, without notice. Here’s some practical steps to safeguard yourself against it and avoid financial ruin by building an emergency savings fund.

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

I had my son at the young age of 22.

It was a tumultuous time. My then-husband and I had gotten ourselves in a heap of financial trouble.

Tension kept mounting until we decided to call it quits only a year and a half later.

Suddenly, I became a young single mother. It didn’t sound half bad to be honest. Sure, I had a lot of debt and no savings, but I had a good job at the time and I had just finished my accounting degree.

What could go wrong?

Only a few short months later, the company I was working for went belly up. It was March of 2008, and I distinctly remember the day I was called into the office.

I pleaded with my manager, but he said there was nothing he could do.

The company just wasn’t making enough money and they were shutting down for good.

Just like that, I became an unemployed young single mother. My world came crashing down.

I spent nine months on unemployment, receiving $1,200 each month.

Thankfully, I was able to get those benefits extended from the customary six-month period. With rent costs at $750, I had little wiggle room for everything else.

So how did I survive, you ask? I was very careful with how I spent my money. From groceries to the electricity bill, I was always on the lookout for ways to potentially save money.

Coupons became my best friends!

I took advantage of free government programs and of any help I could get.

I shopped at church pantries when available and often participated in free activities at the local parks and libraries.

As dire as my situation became at times, I found some solace in knowing that my circumstances were not unique.

After all, according to CNN, about one out of every four Americans don’t have any savings in the bank to cover an emergency such as the loss of a job or a major illness.

Eventually, I was able to get a job in my field.

I had to take a big pay cut from what I was making before, but anything was better than nothing at all!

Once I had a regular paycheck, I committed to creating an emergency savings fund so I could be better prepared in the future.

So how do you build up an emergency savings fund to avoid financial disaster?

Recognize You’re Not Immune

An emergency savings fund is an amount that you would keep in a savings account in case of emergencies.

The first step to build one is to recognize you’re not immune. Financial disaster can happen to anybody!

The problem many people face is that they are lulled into a false sense of security by the seeming positive outlook of their current situation.

However, we don’t know what we don’t know.

Had I known I was going to lose my job in March of 2008, I would have been more careful with my spending the months prior to that. Perhaps I would have put more effort into paying down some debt or built up my savings at a furious pace. It was a real eye opener for me.

Now, even though I have a stable job, I’m careful to always maintain at least enough in my emergency fund to comfortably cover several months’ worth of expenses should disaster strike again.

Decide How Much You Need

This brings me to my next point. I feel comfortable knowing that I’ll be able to cover several months of expenses from my savings. But we’re all different.

Decide how much you feel comfortable with. Do you want to cover 3 months, 6 months, a year? Whatever it is, be clear on how much that truly is.

We tend to calculate our expenses on the low side, so check your spending trends and be sure to base your estimate on realistic numbers.

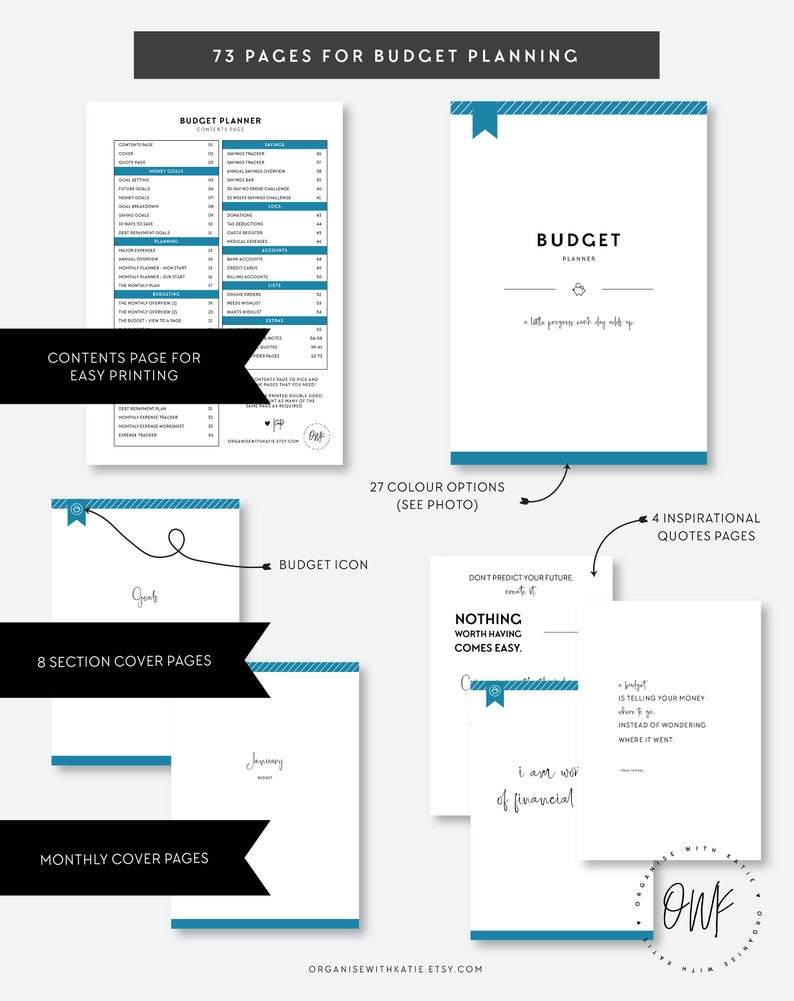

Having a budget should help you with this step. If you need help creating, or maintaining a budget, be sure to download my Quick Start Guide to Successful Budgeting.

It’s free and it shows you step by step how to create a budget from scratch and how to revamp your exiting budget, so it delivers real results!

Also, look at your expenses and figure out which ones, if any, would go away if you were ill or not working.

For example, pulling my son out of daycare while on unemployment saved me about $600 a month.

Analyze your spending habits and come up with a real, solid number.

You can use a planner for this, and I recommend the Ultimate Budget Planner Printables. It’s very complete, with 73 fun and easy to use pages!

Find a Home for Your Money

Once you have your number, you need to figure out where you’re going to store your emergency fund.

You need your money to be relatively accessible, but not “under the couch” accessible. I recommend a high interest online savings account, or a separate savings account at a local bank.

You want to keep your emergency savings fund separate from your regular checking account so that you don’t spend it accidentally.

Personally, I use CIT Bank to store my emergency fund. They offer great APY and excellent customer service. They have three different options for savings accounts and they’re all great choices.

To open your Online Savings Account, check out CIT Bank today!

Create a Plan

Once you’ve decided on how much you need and where you’ll store it, come up with a plan to make that number a reality.

One simple way to build up your savings is to automate them.

If you have the option, request your paycheck to be split in two. One going to your checking account to cover your monthly expenses and a second one going straight to your savings.

If you’re due for a raise or if you have a promotion coming up, earmark any increase in your salary to go to savings.

If that option is not available to you, then be sure to pay yourself first.

Many people fail to save money because when payday comes, they first pay all the bills and spend the rest of the money however they want, saving what’s left.

The problem with this approach is that there will never be any left!

That’s why you must prioritize your savings.

Ideally, you will have already come up with the amount that you can save each paycheck without falling behind on your monthly bills.

Then, it’s just a matter of automatically setting up a transfer from your checking to your savings account for that amount.

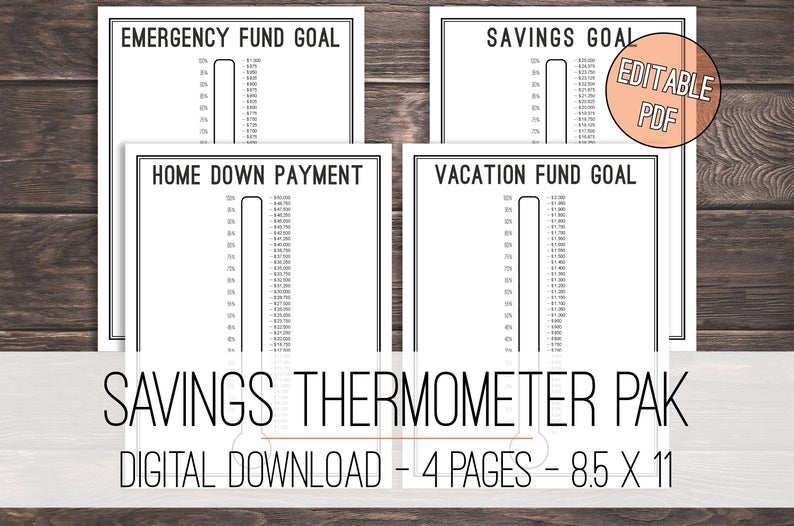

A fun way to track your savings is to use a visual aid like a Savings Thermometer that you can stick to your fridge and update each week.

What if you don’t have any money left for saving?

This is a common question. If you’re struggling to get by as it is, it may seem difficult, or even impossible to start saving!

I wish I could tell you there’s a magical solution, but there isn’t. Your options in this scenario are pretty simple: Either increase your income, decrease your expenses, or preferably, both.

In my case, I kept my expenses at a minimum even after I started working again. I chose to stay at my $750 apartment for another year just so I could save more money.

I also started babysitting for some neighbors and doing a little bit of tutoring to increase my income.

Related Content:

5 Brilliant Ideas to Double Your Salary Fast

How to Land the Perfect Job Every Single Time

5 Ways to Make Some Fast Cash Today

This is easier said than done, but recognize that any sacrifices that you make to build up your savings are temporary.

Keeping your goal in mind will help keep you motivated if discouragement creeps in.

Use Your Emergency Savings Fund Wisely

Emergency savings funds are meant to be used in case of emergency. However, I think we can agree that a flash sale at the local department store does not qualify as an emergency.

Each person’s situation is different. Decide what constitutes an emergency in your family’s case and use your emergency savings fund only for that purpose.

For example, if you live in an area with bad public transportation, and you need your car to get to work, replacing a faulty engine could be an emergency.

However, if you have access to reliable public transportation you can probably put off replacing that engine until it’s more convenient and you have all the money saved up.

Being clear on what’s an emergency will help keep you out of debt.

Lastly, be sure to replenish your emergency savings fund whenever you take out any money out of it. That way, you can ensure that you’ll always be covered for when the next emergency occurs.

An emergency savings fund is a must-have.

In my case, had I built an emergency savings fund prior to losing my job, I could have avoided much financial stress.

Although it may feel wasteful for some to just have money sitting around doing nothing, you won’t regret having it if you ever need it.

As the saying goes, it’s better to have and not need, than to need and not have!

Did you find this post useful? If so, please share it!

What about you? Have you started building your emergency savings fund yet? Share in the comments below!