Become Debt Free On A Low Income: 4 Simple Steps

If you’re overwhelmed by debt and have a low income, it may seem like getting out of debt is impossible. Learn simple strategies on how to become debt free on a low income.

This post contains affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

Today’s post comes courtesy of Andy from PennyLessDad. Andy is a Financial Advisor who went from filing for bankruptcy to becoming debt free in just a few years!

To learn more about Andy, check out his blog at www.pennylessdad.com

How to Become Debt Free On A Low Income

By Andy Masaki – PennyLessDad

Are you overwhelmed with debt?

If yes, you might be noticing a substantial amount of your paycheck is going to pay off your debts. Eventually, you are left with little or no funds at the end of the month.

It means that you are compromising with your financial goals too. So, the time has come for you to get out of debt. But if you have a low income, you might think that it won’t be possible for you to get out of debt ever.

Well, it is possible! Here’s how to become debt free on a low income.

You need to find some strategic ways that can help you to repay your debt without any hassles. Besides, you need to have a mindset to get rid of debt even if you don’t get a handsome paycheck.

Here are some of the best possible ways to become debt free on a low income. Let’s start one by one.

Stretch Your Budget

Hopefully, you are following a budget to maintain a proper spending plan and save money. But now, you need to be smarter with your money. For that, you have to stretch your budget to save more and use that money to pay off debt.

Relook your budget thoroughly and find out the categories where you can trim your expenses. Some of the “wants” may seem like “needs” of your life. But you need to chalk out those categories and reduce those expenses.

For example, a report by NextAdvisor reveals that having coffee at home can help you to save around $1,000 to $2,000 a year.

So, changing your coffee habits can help you save a substantial amount of money. And you can use those funds to dedicate more to your debt payments.

Need a budgeting option on the go? Try the Empower app.

Empower is one of the fastest-growing personal finance apps in the US, with 4.7 stars in the Apple app store and over 650,000 downloads to date.

It features painless budgeting, spend tracking and more. Get started with Empower today to have a host of personal finance tools in the palm of your hand!

Consolidate Your Debts

Are you trapped with unsecured debts?

If yes, then you might be making hefty interest payments every month.

Unsecured debt like credit cards has much higher interest rates as you don’t need to keep any collateral. And if you are trapped with multiple credit card debt, your situation might be worse.

So, to get out of credit card debt, you can consolidate them into single monthly payments with much lower interest.

For that, opt for a balance transfer card to transfer all your existing outstanding balance amounts with a much lower interest rate.

Many credit card companies offer balance transfer cards at a 0% interest rate for an introductory period ranging from about 18 to 24 months. After that, they will start levying a variable or fixed interest rate.

I would advise you to pay off your debt within this period to make the most of the balance transfer card.

During this period, your monthly payments will mostly go towards the principal amount as you won’t have to pay any interest.

So, you can get rid of debt faster and with ease as you won’t have to manage multiple debts. And you will have to shell out much less for your monthly payments.

However, make sure to read the terms and conditions carefully especially about the balance transfer fee, introductory period, and the interest rate after the introductory period ends.

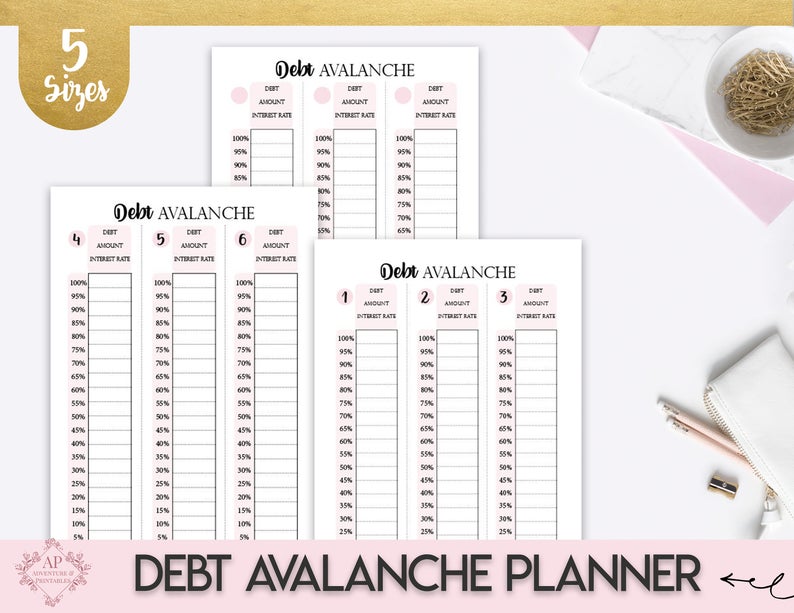

Try The Debt Avalanche Method

In the debt avalanche method, you have to target the debt with the highest interest rate. At the same time, you need to make minimum payments for other debts too.

After that, you have to use the remaining money from your monthly budget to pay off the debt with the highest interest rate.

Once you pay off the debt with the highest interest rate, you will have to move to the next debt with the second-highest interest rate and so on.

You will have to continue this process until you become completely debt-free.

A great tool to help you complete a debt avalanche is the Debt Avalanche Planner. It comes in five different sizes and it’s really easy to use.

You can get yours here:

The biggest advantage of the debt avalanche method is, you can save money on interest payments in the long run.

Because in this method, at first, you have to pay off the debt with the highest interest rate that costs you more.

Eventually, once you pay off that debt, you have to shell out much less for your interest payments.

However, if your largest debt amount has the highest interest rate, then it can take a considerable amount of time to get out of it.

So, in that case, you will have to keep patience and stay motivated to get out of debt.

Opt For Debt Settlement

If the outstanding balance amount is incessantly high and you can’t afford to make monthly payments, you can opt for debt settlement.

For that, you need to negotiate with your creditors to reduce your outstanding balance by paying a lump sum amount.

Start the negotiation by offering 30% of the total amount you owe. Your creditors may not accept the settlement offer in the first instance. After all, who would want to forgo an amount that you owe?

So, you need to keep your calm and have the patience to explain your financial hardship to your creditors. Make them understand why you are unable to make payments.

Once your creditors agree, make sure that you collect the settlement letter in writing to avoid any kind of discrepancies.

Remember, debt settlement may result in a drop in your credit score. Because the creditors will report your debts as “paid-settled” to the credit reporting bureaus. And it will stay on your credit report for up to 7 years.

However, I would say that settling your debt is way better than paying off nothing. If your creditors don’t agree to settle debts, you can opt for a genuine debt relief company who can try to negotiate with your creditors professionally.

So, the bottom line is, to become debt free on a low income is not a cumbersome task. All you need to do is, stop worrying and learn how to get out of debt through strategic and effective ways.

Trust me, once you become debt-free, you will realize the freedom of your life.

You won’t have to worry about the collection calls and managing different due dates.

Amidst this freedom, be responsible with your money and work on achieving your financial goals.

There you have it guys! Andy has great insights over at his blog,www.pennylessdad.com, so be sure to visit his site.

Frequently Asked Questions

Before we go, I want to address some common questions on this topic.

How Can I Get Debt Free Fast?

In my opinion, and from my own personal experience, I think the best way to get out of debt fast is to use the debt snowball or the debt avalanche method.

Having a method in place, and paying off your debt methodically will help you keep focused and motivated.

Also, increasing your income and decreasing your expenses will definitely help you by having some extra cash to apply to that pesky debt and get rid of it quicker.

What Can I Do If I Have No Money?

This is a question I get asked a LOT. How can you pay off your debt when you just don’t have enough money for even basic necessities?

In this case, the fastest way to “get extra cash” is to cut down your expenses. Start there and eliminate everything that’s not absolutely necessary.

Second, do everything you can to bring in extra cash.

Sell your stuff online, fill out surveys for gift cards, spend less by using coupons, switch your bank to CIT Bank and start earning extra interest. You’d be surprised how much extra money you can get by doing little things like these.

The fastest way to get extra cash in many cases is to get an extra job or to switch jobs altogether. There’s been many studies showing that jumping ship to another company often results in salary increases of 10% or more.

If you totally love your job and don’t want to start fresh with another company, you can always start start a side hustle. Whether you’re looking for something remote or not, a great place to start looking is FlexJobs. They have a ton of job listings for both remote and on location work. Check them out!

How Do I Get Emergency Money?

Of course, getting a new job or building a successful side hustle takes time. But what do you do if you need some extra cash RIGHT NOW?

In that case, I suggest doing things locally that you can get paid for right on the spot. This would be things like babysitting, dog walking and the like.

You can also get a cash advance from Empower. Empower is one of the fastest-growing personal finance apps in the US, with 4.7 stars in the Apple app store and over 650,000 downloads to date.

On top of all the great features it has, Empower also lets you advance a bit of cash under certain conditions. Check them out here to learn more!

If you have bad credit and need money fast, you can also opt to apply for a “bad credit loan”.

This kind of loan will probably have a high interest rate, but if you absolutely need money right away, this may be an option to consider to get you out of a bind.

Just be sure to carefully read all the terms and conditions before you sign on that dotted line.

Now over to you! What else has helped you become debt free on a low income? Share your story with us in the comments below.

If you enjoyed this post, please share it!