Calculating Your Emergency Fund: How Much Do You Really Need?

Calculating how much to save for your emergency fund doesn’t have to be complicated. In this post I will show you how to quickly calculate how much you need to avoid financial disaster!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

If there’s anything the world collectively learned in 2020 while battling a world-wide pandemic, is that life is unexpected.

What you think is secure really isn’t. Everything can change in an instant.

That’s why it’s extremely important to have an emergency fund for instances like that. Disaster can strike any minute, and an emergency fund can help you weather the storm without also falling into a financial abyss.

In this post, I will show you how to easily calculate how much you should stash away in your emergency fund to adequately protect your life from financial tragedy.

What is an Emergency Fund?

An emergency fund is simply an amount of money that you set aside to use in case of emergency, as the name implies.

Emergency funds are useful because, when you’re facing an emergency, the last thing you want to have to worry about is money and how will you pay for the unforeseen situation.

Having an emergency fund truly gives you piece of mind in the middle of life’s unexpected “surprises”.

Not only that but having an emergency fund will save you from making financial decisions that you will regret later.

When you don’t have an emergency fund and need to cover a large expense it’s tempting to just put it on a credit card and deal with it later. Many people are forced to take out high interest personal loans to cover unexpected expenses, or overdraft their account.

Having an emergency fund will prevent that from happening to you!

Emergency Fund Examples

Here are some examples of situations in which an emergency fund would typically be used for:

- You unexpectedly lose your job and need to cover your living expenses until you find another job opportunity.

- Even though you tell your spouse to get an electrician, he insists on fixing that sparking outlet himself. He accidentally starts a fire that destroys half your kitchen.

- Your son breaks an arm and you need to pay for his hospital stay.

- Your car finally breathes its last breath on the highway, while you’re running late for work, on the day you have a huge presentation at 9 am sharp.

But What is an Emergency, Really..

The reason why many people don’t keep an emergency fund is because they treat everything as an emergency.

I’m sorry to tell you that a department store’s once in a lifetime sale is NOT an emergency.

So how do you know what truly is an emergency worth breaking the piggy bank?

If you’re trying to determine if a situation truly warrants dipping into the emergency fund, ask yourself what would happen if you don’t deal with the situation at hand.

In the case of your car completely breaking down for example, whether or not it constitutes an emergency depends on a variety of factors.

If you live relatedly close to work and you can easily take public transportation for a while, then replacing your car right away is not so much of a necessity.

However, if you have no other means of getting to work and not having a car can potentially affect your job and livelihood, then getting another car asap is most definitely an emergency.

Each situation will have to be judged on a case by case basis, so try to be objective when determining if you absolutely need to dip into your emergency fund.

Emergency Fund vs Rainy Day Fund

You may have heard of a rainy day fund and have wondered what the difference is.

In essence, an emergency fund is the same as a rainy day fund, only a rainy day fund is often geared towards smaller, everyday kind of emergencies. For example, you forgot your lunch on the kitchen counter and now have nothing to eat at work.

A rainy day fund isn’t really used to cover emergencies like an emergency fund would be.

How Do I Calculate My Emergency Fund?

Calculating your emergency fund is easier than you think!

In a few simple steps you can find out exactly how much you really need to safeguard your life from financial disaster.

1. Check Your Spending Trends

To calculate how much you need in your emergency fund you first need to figure out how much money you would need to cover in living expenses in case of a job loss or other major situations.

An easy way to do this is to use a budgeting app like Mint or Empower that can help you keep track of your monthly expenses.

Simply look at the average expenses you had in the past few months to come up with an average amount you would need on a regular month.

Don’t guess!

When calculating your emergency fund amount you don’t want to simply guess what your monthly expenses are. Turns out, we tend to calculate our expenses on the low side when we’re not looking at actual data.

Also, when calculating your emergency fund amount, remember to exclude any expenses that would go away if you were to lose your job.

For example, if you can stay home with the kids for a couple of months, then don’t factor in the cost of daycare in your calculation.

2. Decide How Many Months You Want to Stash Away

Once you find out how much your average monthly expenses are, the next step in calculating your emergency fund is to decide how many months’ worth of expenses you’d like to have in your emergency fund.

Typically, it’s recommended that you save between three and six months’ worth of expenses, but this really depends on your specific situation.

For example, if your job is in an industry where you can easily find another job quickly in case you lose your current job and you don’t have any dependents, you could get away with saving only three months’ worth of expenses.

However, if you’re the sole income earner of your household and you have a mortgage and two children, then you might want to consider saving up to nine months’ worth of expenses.

Another thing you’d want to consider is how much debt you have. If you have a lot of credit cards and are still paying on your student loan for example, you will want to make sure that your emergency fund comfortably covers your living expenses plus your debt repayments each month.

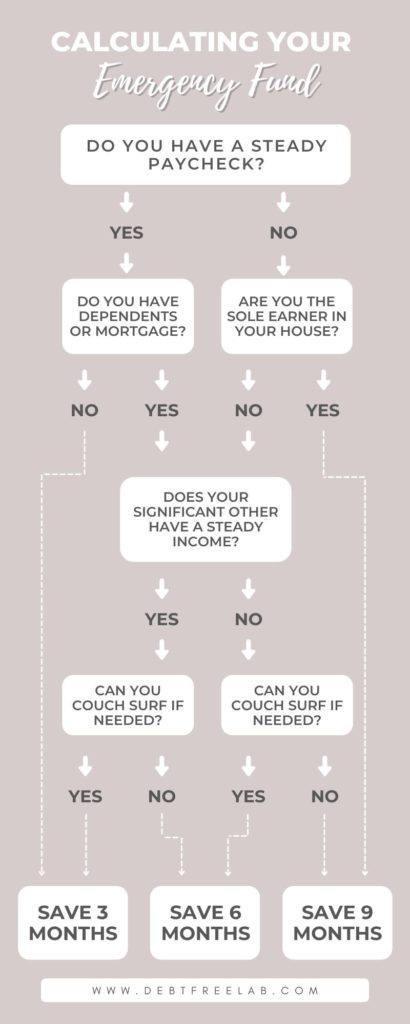

Here’s a handy infographic to help you decide how much you would need to save based on your situation:

3. Make A Plan to Achieve Your Savings Goal

Once you figure out how much you need to save and where you’re going to save the money, it’s time to go past calculating your emergency fund.

The next step is to actually build out that fund!

To do this, you need to have a concrete plan as to how it is that you’re going to make your emergency fund a reality.

The easiest way to save is to automate the process.

If you have the option, I recommend splitting your paycheck so that a portion of it goes straight into your savings account. That way, you don’t even have to think about it.

In any case, you should create a concrete plan to achieve your savings goal.

For example, if you found out from step 1 that your average spending is $4,000 per month, and decided from step 2 that you want to save up 3 months’ worth of expenses, then you know your savings goal is $12,000.

Once you have that number, you can figure out how long it will take you to save up that much. If for example you want to have your emergency fund fully funded in a year, then you know you will have to set aside $1,000 a month for that purpose.

Once you break it down into a monthly amount, it’s easier to figure out in your mind what it is that you need to do to achieve that.

4. Decide Where To Keep Your Emergency Fund

Now that you’ve calculated how much you need to keep in your emergency fund and have a plan to make your goal a reality, you’ll want to decide where to keep it.

You want your emergency fund to be accessible in case of emergency, but not too accessible that you’ll be tempted to spend it outside of an emergency situation.

You also don’t want your emergency funds comingled with your other money. If that’s the case, it would be easy to dip into your savings without even realizing it.

I recommend an online savings account with CIT Bank. That’s what my family personally uses since they offer a higher interest rate than the local banks and is fairly easy to transfer money in and out of it.

Online Savings Accounts Options

Like I mentioned, I like CIT Bank and that’s where we keep our own emergency fund. CIT Bank offers three options for savings accounts:

Savings Builder Account

The CIT Savings Builder account offers up to 0.40% APY at the time of this writing. However, it has gone up to up to almost 2%, which is a whole lot than what the local bank would offer.

You can open your account with only $100 and making a monthly deposit of just $100 will waive the minimum balance requirement of $25,000!

The best part is that there’s no account opening or maintenance fees. Open a Savings Builder Account today!

Savings Connect Account

The CIT Savings Connect account offers up to 0.50% APY at the time of this writing. This account allows you to access your funds through any US ATM with a debit card.

By linking your Savings Connect account to an eChecking account you can access many more benefits. Additionally, if you choose to deposit $200 or more into your linked eChecking account, you can get the top APY on your Savings Connect Account. Open yours here!

Money Market Account

The CIT Money Market Account offers up to 0.45% APY at the time of this writing. This account is great for storing your emergency fund and it’s the one my family personally uses. It doesn’t carry a monthly service fee and it’s pretty easy to transfer money to this account from your local checking account.

You can also deposit checks remotely and make transfers with the CIT mobile app. Start saving with a Money Market Account today!

Discover Online Savings Account

Another great option to store your emergency fund is Discover’s Online Savings Account. This account offers up to 0.40% APY at the time of this writing, has zero monthly fees and there’s no minimum opening deposit.

Discover’s mobile app is also really user friendly and allows for easy transfers on the go. Open your Discover Online Savings Account here!

Frequently Asked Questions

That’s about it for calculating your emergency fund!

Before we finish off though, let’s address some frequently asked questions on this topic.

Is a 3 Month Emergency Fund Enough?

While the rule of thumb and recommendations by the experts have been to estimate between three and six months, everybody’s situation is different, so your emergency fund needs should address your specific situation.

You can use the handy infographic on this page to give you an idea of how many months you should have in your emergency fund and if three months would be right for you.

As an alternative, you can use the interactive emergency fund calculator by Money Under 30 to get an idea of how much you should be stashing away.

Which Is The Best Place to Save Your Emergency Fund?

As I mentioned earlier, you want your emergency fund to be accessible but not too accessible. An online savings account is perfect for this since you can still transfer funds out of the account fairly easily but you don’t have the money at your fingertips to spend at a moment’s notice.

You can check out online savings accounts by CIT Bank or Discover Bank. Both are pretty well recognized, have excellent customer service, and pay way above the local bank’s average.

I Can’t Afford to Save. What Do I Do?

I know at times it may seem that it’s “too expensive to save money”. If you’re in a situation where you’re barely making ends meet or simply don’t have room to save, thinking about saving thousands of dollars to cover several months of expenses can seem daunting.

If this is your case, start small. Something is better than nothing!

Set a small goal of saving whatever you can each month and work your way up once that amount feels comfortable for you.

If you truly can’t cut back on any expense whatsoever, then the alternative would be to increase your income. Try to pick up extra hours at work or find simple ways to make some extra cash on the side.

Final Thoughts

Calculating your emergency fund amount doesn’t have to be complicated.

It really boils down to familiarizing yourself with how much you spend a month on average and then deciding how many months of that you would feel safe having stored away.

Every situation is different, so make sure you feel comfortable with the amount you decide on instead of just following a cookie cutter formula. Use those formulas as high level guides, but then adjust according to your specific needs.

In my case, I normally aim to keep about six months’ worth of expenses stored away, but adjust it to nine months if I know I’m planning on making any changes to my housing or job situation.

I guess my motto is to hope for the best but prepare for the worst!

How about you? How much do you feel comfortable with when calculating your emergency fund?