4 Proven Steps to Get Out of Debt Quickly

If you have piles of debt and don’t know what to do, read on to find out 4 steps you can take to get out of debt quickly!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

One of the questions that I get asked often is which debt to pay off first.

There’s much discussion out there as to which method works best or is most cost effective when it comes to getting out of debt quickly.

Which Method Works Best?

There are various schools of thought in the subject. Some will say that you should pay off the debt that carries the highest interest first, and some others will say that you should pay off the one with the lowest account balance first.

Here’s a nice graphic from our friends over at MLS Mortgage to explain the difference between the two methods:

My opinion?

You can use a combination of both, depending on what works for your particular situation and your personality, to stay motivated throughout the process.

Do you get discouraged easily? Then I recommend the debt snowball method since it’s going to allow you to see some progress faster than if you were to focus on high balance accounts first.

Don’t mind to wait for results as long as you win in the end? Then the debt avalanche is probably better for you, since this method tends to save more interest in the end.

Related Posts:

3 Reasons Why You’re Still in Debt (& How to Fix it)

How to Pay Off Debt According to Your Personality

3 Brilliant Ways to Painlessly Curb Your Spending

How to Get Out of Debt Quickly

Here’s the step by step method I used to get out of debt quickly.

Copy these 4 steps to say bye to debt for good!

Build Up Your Savings

I first saved up a couple thousand dollars designated for debt payments so I could have some leverage.

This is important since some creditors will want to give you a discount in exchange for a payment up front.

For ideas on how to build up your savings, check out the Save Money section of the blog.

Another way to have some extra money to get out of debt quickly is to get a personal loan.

Since even a difference of a few interest points can really give you a push in the right direction, getting a loan for say, 10% interest will do wonders to help you pay off a 25% credit card and other high interest debt. Check out if you qualify here:

List Out All Your Debts

I then listed all my accounts, their balances and their interest rates.

You can use a debt tracking app to do this for you.

I recommend the Pay Off Debt app. It’s available for iPhone or Android, it’s really simple to use and it lets you see right away which of the two payoff methods would work best for your particular situation.

If you prefer to do things the old fashioned way, I recommend using this Debt Tracker printable, which allows you to list all your debts in one place.

Prioritize Your Debts

Having a method is important if you want to get out of debt quickly. It helps keep you organized and focused.

After I had a clear idea of what I owed to whom, I contacted each creditor to try to work out a settlement or payment plan, giving priority to the smallest balance accounts.

This is what you would call a Debt Avalanche. If you want to read more about why this method worked best for me, check out this blog post!

Negotiate With Your Creditors

Then, I settled or paid off the accounts that were willing to give me a bigger discount first.

For those accounts that would not let me settle for anything other than my account balance, I paid them off from smallest to largest balances.

For example, I owed a medical bill for $500 as well as $1,800 to my phone company.

When I tried negotiating with these creditors, my phone company was willing to settle the whole balance for only $900 (a 50% savings)! The medical creditor only offered me a 20% savings.

After much negotiating, I believe this was the best I was going to get, so I settled the phone bill first, then the small medical bill.

What I’d like to emphasize is that the best method is the one that will save you the most money in the long run but will also keep you focused and motivated.

Any debt repayment method will fail if you don’t see it through.

Sure, not paying a ton of interest is great, but if you can settle a debt that’s not necessarily next on the list at a deep discount, you should take advantage of that offer.

Additionally, small wins are important – specially at the beginning – to boost your confidence and keep you going!

Recommendations

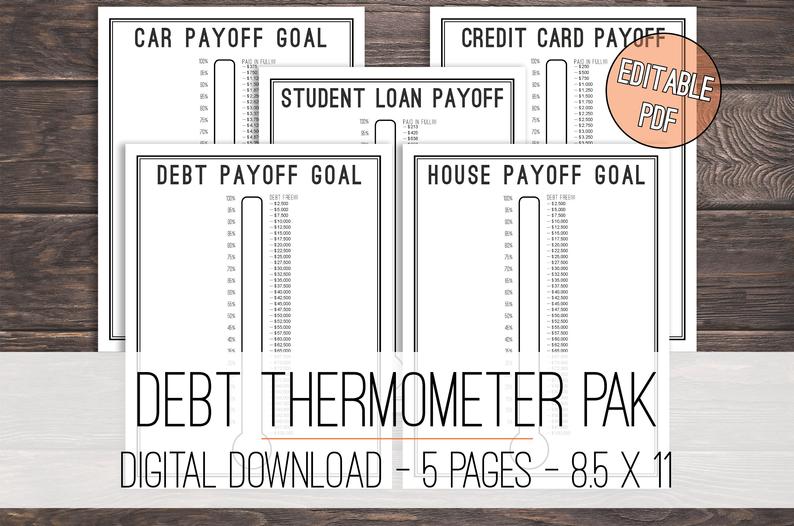

One thing I do recommend, is that you write down the list of your debts and place them in a visible place, such as the fridge with this handy Debt Thermometer Tracker.

As you pay off each one, cross it off. Not only is this a great motivator, but it also allows you to visualize the end goal, which will help you stay on track to get out of debt quickly.

If you prefer to keep track of your debts on your phone, try the Pay Off Debt app, or a debt payoff planner app for iPhone or Android for on-the-go information on your payment progress.

For those times that you’ve already tried everything you could do and it just didn’t work – maybe your creditors are difficult to work with and just won’t budge a bit – then I recommend to work with the experts, like CuraDebt.

They’re a top rated debt relief company that offers amazing customer service and a variety of programs depending on your particular situation.

For more tips to get out of debt quickly, download my Quick Start Guide. Learn the exact steps I took to pay off over $50K in debt and how they can help you get off the debt cycle once and for all!

Have any debt repayment success story you’d like to share? Be sure to comment below!