Negotiating With Debt Collectors: 5 Insider Secrets You Need to Know

Learn how negotiating with debt collectors can help you become debt free faster. Peek behind the curtain into these 5 insider secrets you can use to slash your debt in half!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support! Graphics and creative material for advertised products belong to the original creator.

Dealing with a lot of debt can be stressful.

Trust me, I know.

Several years ago I started working on paying down my debt. One of the first steps I took was to sit down and make a list of everything I owed.

It was over $50K!

I was terrified.

That was a lot of money that I didn’t just have lying around, and the pressure was on from the debt collectors.

I had to do something.

When I started working on one of the smallest bills, I was surprised to hear the creditor offer me a settlement. Up until that point I didn’t even know that paying less than what I owed was an option.

The bill was originally $85, yet, the collection agency offered to close the account with a payment of only $60. I had $50 available at that time, so I asked if they could take that amount instead.

To my amazement, the debt collector said yes!

That one phone call with the collection agency proved to be eye opening and life changing for me. It triggered a mindset shift that allowed me to become debt free much faster than I ever could before.

On that one call, I took the deal, and I got a great idea.

If I was able to settle that If I was able to settle that one bill for less, surely it wouldn’t hurt to try doing the same with the larger ones, could it?

Armed with new determination, I set off to call every single one of my creditors.

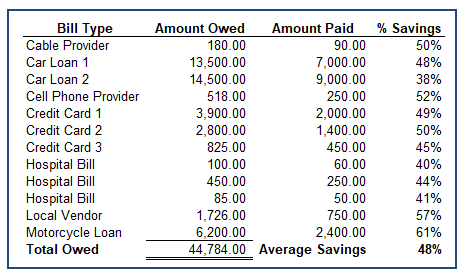

It took almost 3 years to pay it all off, but I’m happy to report that I was able to settle most of my bills with an average savings of 48% on the original amount owed.

That’s almost half of what I started with!

Making offers to debt collectors and settling collections accounts for much less than what I owed was the single most important thing that propelled me to become debt free much faster.

So today I want to show you how to negotiate a debt settlement on your own.

Can You Negotiate with a Collection Agency?

Just like me prior to that one fateful call, you may think that the only way you can settle a debt is by working with a debt settlement company.

Thankfully, as illustrated by my experience, settling with credit card companies yourself, and with other types of creditors is not only possible but totally doable.

I do have to warn you, trying to settle with a collection agency will not work every single time. Some companies will offer you only a minimal discount, some other ones will not take any discounts at all. But the majority of debt collectors will rather settle the account for something than take no payments at all.

Some of the debts I couldn’t settle included student loans and a couple of credit cards. They just would not budge.

Here’s a list of everything I was able to settle and for how much:

As you can see from the list, almost any type of debt can be negotiated down.

Let me show you how.

How to Negotiate with Debt Collectors for a Lower Settlement

I know that just the thought of speaking with a collection agency can be intimidating, let alone negotiate with them.

However, when you break it down into small, doable steps, it really isn’t that bad.

These are the exact steps I took when I started negotiating with debt collectors. So grab some pen and paper and let’s go through the entire process step by step.

1. Make a List of What You Owe

When it comes to making offers to debt collectors, organization is key.

At some point, I was getting so many calls from so many different collections agencies, that I honestly lost track of who I owed what.

The first step to deal with your debt is to have a clear picture of what you owe. You’re also gonna want to know how you can get in touch with the creditor.

The easiest way to get all that information in one convenient place is to get a copy of your credit reports.

As a consumer, you have the right to get your credit report for free once a year, through www.AnnualCreditReport.com.

However, if you choose to go this route, you’ll only get your report (the history of your credit). There will be no insights behind it.

My favorite way to get my credit report is to pull it from MyFICO.

This is the consumer division of the company that invented the FICO scoring model. Getting your reports this way is going straight to the source!

This site offers great resources and insights.

With myFICO, you’ll be able to get your free credit report complete with contact information for each creditor.

You’ll also get your credit score and a summary of what’s hurting your credit. This will help you have a better idea of how to fix it.

2. Build up a Debt Repayment Reserve

Once you have an idea of what you owe, the next step is to build up some savings.

Why?

Some creditors will allow you to make a payment arrangement or offer you a discount only if you can “lock it in” with a deposit.

You need to be prepared to pay at least some money up front.

For tips and resources on how to save money, check out that section of the blog here.

For a step-by-step guide on how to revamp your budget to make it work for you, sign up for my Quick Start Guide to Successful Budgeting.

3. Polish Your Negotiation Skills

Once you have a clear idea of what you owe and you’ve built up a little debt settlement fund, you’re ready to start making some phone calls!

Here are some things you can do to take the dread out of calling your creditors.

Prepare Yourself

Dealing with collectors can be intimidating.

After all, they are trained to collect money whereas you may not even know how to start the conversation.

Before you make any calls, prepare yourself by either role playing the call with a friend or family member.

You can also write down a rough script of what you’d like to say.

To start the conversation, state your name, the bill you’re calling about and that you’d like to see what payment options there are.

If the first person you speak with gives you no options, simply thank them and call back later or another day.

Ask to speak with their settlement or payment arrangement department, if they have one.

If at all possible, don’t say you want to settle for X amount. Instead, ask how much will they be able to settle for. If they insist that you offer an amount instead, start with a much lower amount than what you actually can pay.

Before you actually commit to any kind of payment, try to negotiate it to be as low as possible. So if they do offer you a settlement amount, offer a lower amount.

It may seem simplistic, but you’d be surprised how many times somebody will give you a discount or other concession just because you asked nicely.

In any case, try to find an amount where you both can “meet in the middle”.

Note that with some creditors, you can arrange for a payment plan even for the settlement amount.

Make a record of every interaction you have with them. Include the time, day, and the name and ID number (if possible) of the person you’re speaking with.

This may come in handy if the creditor doesn’t want to honor the arrangement after the fact.

Be Proactive

Getting collections calls all day is no fun.

It can be really stressful and it can put you in a defensive mood. However, there’s a better way.

You can take back control!

Instead of waiting for the debt collector to call you at a time when you may be stressed and prone to committing to something you shouldn’t, pick a time and a place that’s comfortable and convenient for you and give them a call.

Make sure to have pen and paper ready to write down any relevant information.

Check the Date

Also make note of the date the account was first noted as past due or in default.

Although past due and collection accounts fall off your credit report 7 years after they were first reported, in some jurisdictions, that clock can “reset” whenever you attempt to pay that debt partially or in full.

Before you make any attempts to settle a debt, check the rules for your particular location with your State Attorney’s General Office.

If this rule does apply to your state: If you aren’t trying to increase your credit score right away so you can make a home purchase or the like, you may be better off waiting for bills close to the 7 year mark to just fall off your credit report.

Build a Case

Make a note of any settlement offers either they or you make.

This will help you “build a case” to show you are willing to work with them.

The more records you have of attempting to pay off your debt, the more willing they may be to actually offer you a settlement for less than what you owe.

Build Rapport

Lastly, be calm and polite.

Asking someone how their day is going goes a long way.

Also, don’t take things personally. If the particular debt collector you’re speaking with doesn’t want to give you any concessions or is clearly hostile to you, take it in stride and try your call again later with a different person.

If the collector begins to mistreat you, make threats, or otherwise make you feel uncomfortable, say you will call back later and hang up.

Just because you owe them money doesn’t mean they can treat you badly, plus, it’s against the law.

Related Posts

How to Buy Everything You Want (And Not Owe Anything)

Rule Your Debt in 4 Simple Steps

How to Pay off Debt Fast According to Your Personality

4. Know Your Rights

Debt collectors may often try to use threats, intimidation, emotional appeals, and other dirty tactics to get you to pay.

As you deal with your collectors, point it out to them if they begin to infringe on your rights.

According to the FTC, the Fair Debt Collection Practices Act (FDCPA) prevents debt collectors from contacting you between 9pm and 8am, or at times they know are inconvenient for you.

They also can’t call you at work if they know you’re not allowed to get calls at your workplace.

Collectors also cannot threaten, harass you, or make false statements (like telling you they can send you to jail if you don’t pay off the debt).

Click here to read the other rules outlined on the FDCPA.

To report a collector in violation of these rules, you can file a complaint with your State Attorney’s General Office.

5. Document Your Progress

There’s nothing more satisfying than to cross an old debt off the list.

As you pay down your bills, be sure to document your progress so you can remain motivated, even if things don’t always go as planned.

An easy strategy to stay motivated is to have a visual of your progress.

Here’s my favorite ways to track my debt repayment progress:

Debt Thermometer Tracker

This is a simple and fun visual you can put on the fridge or a high traffic area.

It’s really easy to use and it’s really fun to fill it out each week!

You can get your here:

Debt Pay Off App

With this app, you can easily organize your debts in one spot and track your progress.

Also, you can calculate what debt repayment method will help you pay off debt fast!

You can download it for iPhone or Android here.

Frequently Asked Questions

Before you start making those phone calls, let’s address some common questions that come up quite often about negotiating with debt collectors.

How do I Deal with Debt Collectors If I Can’t Pay?

Like I mentioned before, I suggest saving up some money that you could offer up front as part of a settlement before calling the collection agency.

The easiest and fastest way to get extra cash in your pocket is to carefully look at your personal finance spending and see where you can cut some corners.

Ask yourself if there’s any leeway in your budget where you could be saving some money that you could then use towards a debt repayment plan.

If you truly can’t come up with a lump sum amount of savings to offer your creditors, then you can at least try to negotiate with them for better terms.

For example, I was unable to settle several accounts for a lower amount. However, I was able to get other concessions, such as a lower monthly payment or a lower interest rate.

Again, if you never ask, you will never know what’s possible, and every bit of flexibility you get with any of your bills will help you make more progress in the long run.

How Much Will a Debt Collector Settle For?

You’d be surprised by how little will a debt collector settle for sometimes. It really all depends on who you speak with and how willing they are to work with you.

That’s why it’s important that you don’t give up if the first person you speak with tells you no. Just call again and again until you get to speak with someone who has the authority and the disposition to help you out.

In my case, by following this technique, I was able to settle my accounts in collection for an average of 48% of what I originally owed. That’s basically half of what I owed!

What Percentage Should I Offer to Settle Debt?

Remember to always negotiate at a lower starting point than what you are willing and able to pay.

Say the amount of money you owe on a credit card account in collections is $1,000 and you can pay $600.

Begin by trying to get a settlement for $400. If they just won’t take it, you can work your way up slowly and hopefully end up paying even less than the $600 you were willing to pay to begin with.

Is it Bad to Settle a Debt with a Collection Agency?

Debt settlement is by far the one tool that will help you become debt free faster. However, there are some caveats you should be aware of.

Don’t Restart The Clock

First, as mentioned before, make sure you’re not attempting to settle a debt that will naturally fall off your credit soon anyway. You don’t want to reset that clock and have that negative mark on your credit for another 7 years.

Beware of Taxes

Second, you should be aware that if the amount of money the collection agency is forgiving on your account is more than $600, you’ll likely owe taxes on the forgiven amount.

If you settle an account for more than $600, make sure the collection agency has your information up to date. The last thing you want is for them to mail you a tax form that you never receive and then owing penalties and late fees on that… Ask me how I know (face palm)!

Your Credit May Get a Hit

Third, be prepared for your credit score to take a hit in the short run. This may seem counter-intuitive, but the credit bureaus may ding your credit for settling a debt.

Why? Because not paying the amount in full may make you look like a credit risk to some creditors.

This is unfortunate, but remember that making an effort to pay your bills, even if for a lower amount, is better than not paying at all, and that’s the position many creditors will take.

Also remember that not paying your collections accounts at all will also continue to hurt your credit for as long as that account is open before it falls off your credit.

Watch Out For Scams

Lastly, before making any payments, make sure you’re speaking to the correct company.

Once an account has been sent to collections, you should be speaking to the collections agency, not to the original creditor.

Most importantly, you should make absolutely sure you’re speaking to a legit collection agency and not a fraudster impersonating a debt collector.

The easiest way to ensure this is by calling the number listed for the collection agency on your credit report.

All in all, although negotiating with debt collectors for a settlement can have some perils, the benefits you can obtain from it far outweighs the risks.

Final Thoughts

Be patient and don’t give up!

Know that no matter what your interactions have been with your creditors up until this point, you can follow the simple steps outlined here to regain control of the conversation.

Debt can be overwhelming, but by applying these tips, you’ll be able to get to start living debt free much faster.

Get organized, negotiate, and be patient.

In time, you’ll see the results of your hard work, and you’ll be glad you didn’t give up on your debt repayment goals.

Do you have a success debt negotiation story? Share it with us in the comments below!