How to Buy Everything You Want (and not Owe Anything)

Love shopping but hate the credit card bill the following month? Here’s some ways you can buy everything you want without ever owing anything.

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support! Graphics and creative material for advertised products belong to the original creator.

Shopping sprees can be a lot of fun.

Some say it may even be therapeutic (the jury’s still out on that one though).

However, buying everything on credit with the hopes of being able to pay for it the following month can add unnecessary stress to your life.

One of the main reasons why I found getting out of debt extremely difficult was that I was on an endless debt cycle.

Each month, so much of my income would go to debt repayment for things I had bought the previous months, that I was forced to pay for most, if not all of my current month’s expenses on credit.

After many months living in this loop, I implemented several strategies that have since helped me get out, and stay out, of debt.

I learned how to buy everything I wanted without owing anything.

Here’s some ideas on how you can do it too! (For a more in-depth step by step guide, sign up here to receive my free Quick Start Guide on Paying off Debt).

Build Up Your Savings

One of the most effective ways to purchase whatever you want without going further into debt is to build up a fund or reserve to use for your purchase.

Although this may sound easier said than done, if you commit yourself to get off the debt cycle, you will be able to “find” the money you need for your purchase.

A couple of overtime hours or an extra weekend job a couple of times a month can help you accomplish this.

- Do you like pets or kids? Create a profile on Care.com and start making some extra money by taking care of other people’s kids or pets.

- If you don’t mind driving, pick up a couple of rides with Uber or Lyft. My cousin recently tried it and she made an extra $80 in only two hours of driving.

Don’t have extra time to pick up additional shifts?

Get creative! Sell anything you don’t have a use for anymore:

- Sell old books on BookScouter.com

- Have old video games and gaming systems? Sell them to GameStop

- Sell old phones through Gazelle.com

- You can also sell music records or musical instruments that you no longer use on Reverb

- Sell anything else, from clothes to wheelchairs, on apps like OfferUp or Letgo.

To know how much extra cash you’ll need to find, simply estimate how much you need to save to buy what you want, and divide it by the number of months or weeks left until you plan to purchase the item.

This is called a sinking fund.

For example, I love shopping on Black Friday. If I plan on spending $600 that day, I would save about $100 each month for 6 months, starting in April or May so I can have some wiggle room until the end of November to set aside that planned amount.

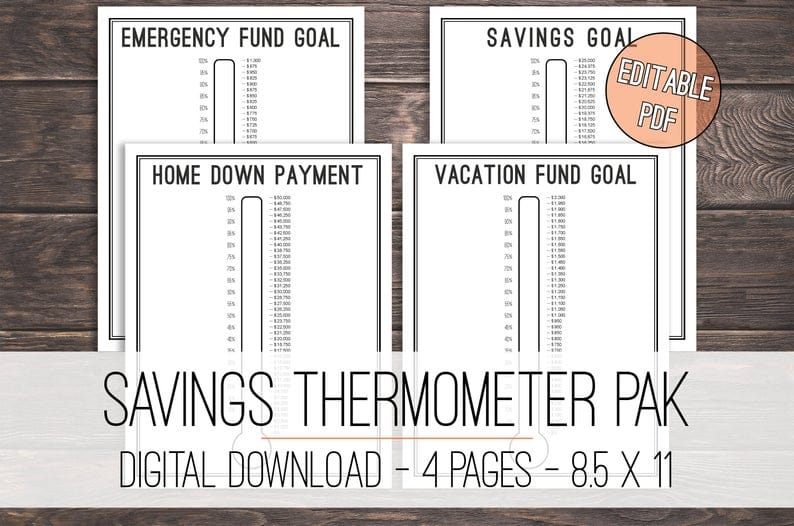

You can use a visual aid like a Savings Thermometer to help you save up.

I personally find being able to fill in the thermometer quite exciting and motivating! You can get yours here:

Sleep On It

Have you ever heard of a One Day Only sale? There’s a certain department store that has these every Saturday.

Don’t let those kinds of sale tactics pressure you into buying something you’re not ready to get.

Before you whip out the plastic, allow yourself a day (or at least a few hours) to do some research to make sure you are actually getting a good deal, and to think about whether or not you truly need the item.

Chances are, if you go back to the same store tomorrow, they will still be having their One Day Only sale, and the item may not be as appealing to you as it was yesterday.

As a rule of thumb, the larger the purchase, the longer you should consider it.

If you can’t “sleep on it” – say you’re at the mall and you won’t be coming back soon – you can allow yourself some time to think about it by walking away for a while.

In these situations, if there’s something I want, I walk away and decide if I want to go back for it before I leave the area.

More often than not, I find that the item I wanted is not worth the trek back, and I conclude that I didn’t want it as badly as I originally thought.

Related Posts

Insomnia Can Derail Your Finances. Here’s How to Keep Them on Track

3 Debt Payoff Tips That Guarantee Success

How to Get Out of Debt by Changing this One Simple Habit

Rest Well

Did you know that we’re more prone to make bad financial decisions when we’re tired?

According to Forbes, the more tired we are, the more we’re prone to experience decision fatigue.

This is where our brain doesn’t have the energy to process all the information it needs to make a good decision.

Instead, it will default to the easiest decision, which may not be the best for us.

How can you fight back?

If you’ve had a bad night, try to avoid making any purchases on credit.

Allow your mind some time to recoup and recharge prior to signing on the dotted line.

Avoid Temptation

Another tactic that’s fairly easy to implement is to avoid the temptation of purchasing altogether.

If you know you don’t have any extra cash this week, avoid going to the mall or to your favorite store.

Rather, use this week to build up extra cash.

When I’m on savings mode, I limit my exposure to places of commerce and I only carry a minimal amount of cash on me in case of emergency, and no credit cards at all.

That way, even if I’m tempted to buy something, I won’t have the means to pay for it.

That’s it guys!

These 4 strategies have allowed me to get out, and stay out of debt. The more you practice them, the easier they’ll become!

Saving money or budgeting doesn’t have to mean not ever buying what you want.

By using these simple techniques, you’ll be able to responsibly indulge yourself in what you’d like to purchase without ever owing anything for it.

What other strategies have you used to avoid getting further into debt? Share them in the comments below!