The Debt Avalanche Method Explained (With Infographic)

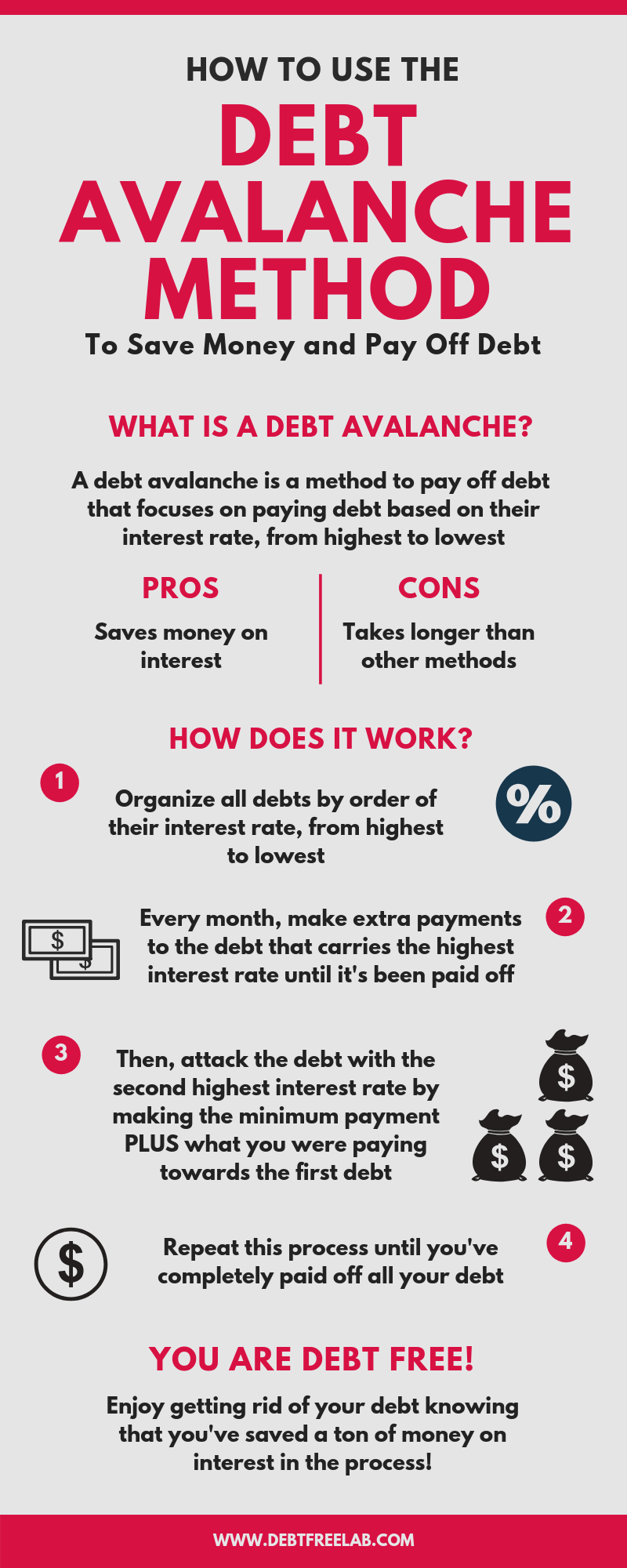

The debt avalanche method to pay off debt focuses on saving money on interest by paying off the highest interest debts first.

Today, I wanted to share with you an infographic to explain how this method works.

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

The debt avalanche method to pay off debt focuses on paying off debts depending on the interest rate they carry, from highest to lowest.

The theory behind this method is that by organizing your debts in this way you end up saving money on interest in the process.

While this is true, the downside to it is that it may take longer to see any real progress.

If you want to learn more about the EXACT steps I took to get out of debt once and for all, download my Free Guide to Paying Off Debt here!

How the Debt Avalanche Method Works

This infographic explains how this method works:

Does the Debt Avalanche Method Really Work?

It depends.

If you are patient and can wait a while to see results, this is a great method to use.

This method also works great for people who prioritize saving money in the long run, rather than seeing immediate results.

A great tool to use for this method is the Debt Avalanche Planner.

This tool helps you organize your debts and plan out your avalanche payments. You can get your here!

Are There Other Methods?

Yes!

There are multiple methods to pay off debt.

These include the debt snowball method and the debt sprinkle method, which I will discuss in further detail in future posts.

But just to give you a high-level overview, the debt snowball involves paying off your debts starting with the smallest balance and working your way up to the largest debt you have.

The idea behind the debt snowball is that you’ll feel more motivated to pay off all your debts when you experience the satisfaction of quickly paying off the smaller debts first.

The debt sprinkle method simply focuses on making lots of additional payments besides your monthly minimum payment. It can also be used alongside any other method!

Is It Better to Snowball or Avalanche?

If you’re struggling with motivation, I would suggest to do a snowball method. Otherwise, the debt avalanche will help you get out of debt faster – mathematically speaking.

By attacking your high-interest debt first, you’ll not only pay less on interest in the long run but you’ll also bring down your balances faster.

How Do I Know Which Debt to Pay Off First?

To find out which debt to pay off first in a debt avalanche, start by pulling up the account statements for all your debts.

Look for the interest rate typically listed at the end of the statement. Write this down for each one of your debts.

Lastly, organize your debts starting with the highest interest one and working your way down.

This is the order you would attack your debts in a debt avalanche!

A great tool to use for this method is the Debt Avalanche Planner.

This tool helps you organize your debts and plan out your avalanche payments. You can get your here!

Related Posts

The Debt Snowball Method: Does it Really Work?

How to Pay Off Debt Fast According to Your Personality

The Debt Snowball Method Explained (With Infographic)

To learn more about the exact steps I took to pay off debt and how you can replicate them, be sure to sign up for our free Quick Start Guide to Pay Off Debt.

What has your experience been with the debt avalanche method? Share with us in the comments below!