The Best Budget Categories (Infographic)

Did you know that the categories that you use in your budget can make a difference? Check out this list to find out if your budget categories as effective as you’d like them to be!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

Budgeting comes in all shapes and sizes. Some will budget using a zero based budget, others will budget using a percentage rule.

The diversity doesn’t stop there!

Do Budget Categories Matter?

When it comes to budgeting categories, they could be really specific or extremely broad. But does it make a difference?

I believe so!

If you have too broad of a broad category, such as “housing”, and you use it to track every kind of expense you may incur for your home, it may be too high-level to provide you any useful insights.

On the other hand though, if your categories are too narrow and detailed, this may work against you by hiding your spending habit and trends.

Over the years, I’ve adjusted my budgeting categories a few times until I’ve found a good mid-point. By doing so, I’ve been able to make significant progress in my finances over the years.

If you’d like to learn more about how to make your budget work for you, download my Free Quick Start Guide to Successful Budgeting today!

Related Content:

5 Quick Tips for a Successful Budget

5 Amazing Tools to Rule Your Money This Year

3 Brilliant Ways to Painlessly Curb Your Spending

Whatever budget categories you choose, or how you choose to group them, try them out for a couple of months, but don’t be afraid to make any adjustments as you see fit!

In the end, the best budget is one that works for you and your family, and that you will be able to stick with consistently.

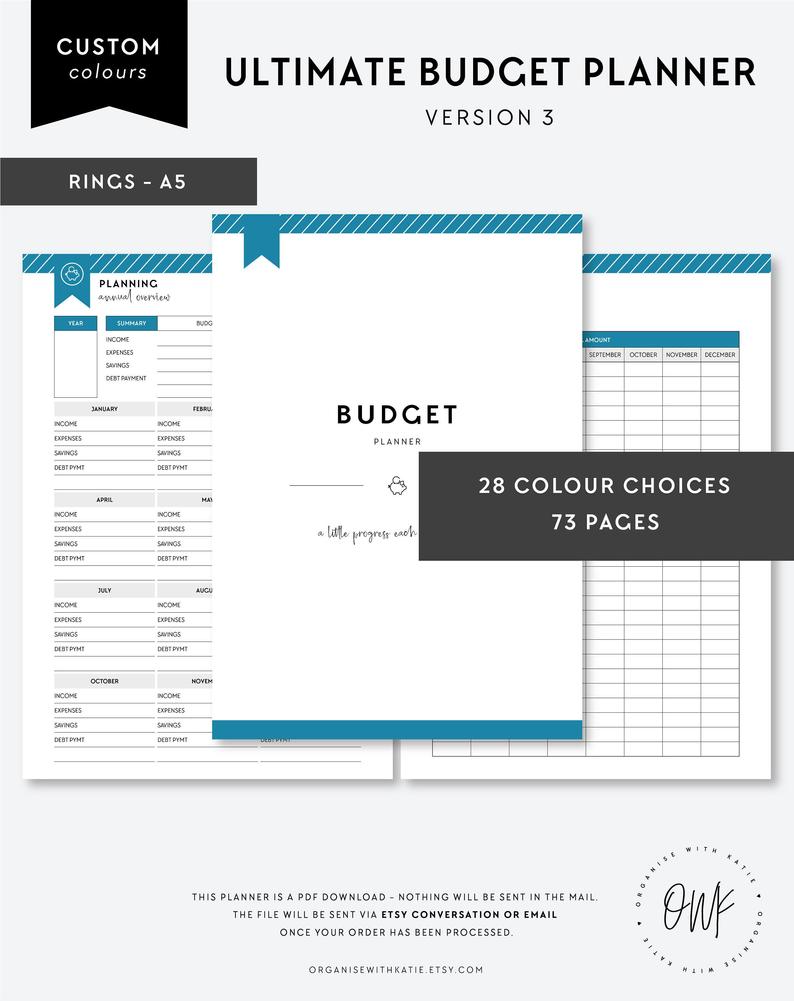

When it comes to keeping a budget, I recommend using a budget planner to keep you organized. One of my favorites is the Ultimate Budget Planner. It’s customizable and comes with tons of useful tools!

Check out the Ultimate Budget Planner here:

What Are Examples of Monthly Expenses?

Monthly expenses can be grouped into what type of expense they are. A good budget plan will account for expenses in what I would call “order of importance”.

That way, if you’re in a pinch, you’ll know which categories you should look at first to cut costs and corners, and which will be more difficult to rearrange.

When you consider your budget categories, try to think of all the things you pay for in a month. Normally, you will have essential expenses, and non-essential expenses to include.

What Are Essential Expenses?

Essential expenses would be those expenses that are truly a necessity. Now, I’m not talking about the “I need a bigger TV” kind of necessity here 😉

I’m talking about food, housing and utilities. If you absolutely need a car to get to work, then your car-related expenses would also be considered a necessity.

Non-essential expenses on the other hand, are basically the leftover expenses.

That would be things like entertainment, dining out, gifts and the like.

What Budget Categories Should You Include?

The best way to find out what budget categories you need to incorporate in your budget is to review your spending for the last couple of months.

To get you started, here’s a list of budget categories you may want to include. Of course, this will work differently for each household depending on your particular needs.

Housing Expenses

Rent or mortgage payment

Home Repairs and maintenance

Association fees

Home protection or security

Taxes and Insurance (If not included in Mortgage Payment)

Debt Repayment

Car Loan

Student Loan

Credit Card

Store Card

Utilities

Electricity or Gas

Water, trash and sewer

Internet

Cable

Phone

Medical and Health Expenses

Insurance (if not deducted from paycheck)

Copayments

Routine Medicine

Non-Routine Medicine

Medical Devices

Accident Insurance

Dental Expenses

Personal Care

Clothing

Dry cleaning

Hair Care

Nail Grooming and Maintenance

Skin Care

Gym memberships

Toiletries and Other Supplies

Savings

College Fund Contributions

Retirement Contributions

Education and Child Care

Tuition

Books and Supplies

Uniforms

Daycare Tuition

After-school activities

Child Support Payments

Tutoring

Allowances

School Lunch

Food

Groceries

Dining Out

Alcoholic Beverages

Entertainment

Movies

Children Activities

Vacation Expenses or Vacation Fund

Gifts

Pet Expenses

Grooming

Medicine

Pet supplies

Pet toys

Room and Board

Transportation

Insurance

Registration or Taxes

Maintenance and Repairs

Gasoline

Public Transportation

Parking

Tolls

Miscellaneous

Charity or Donations

Subscriptions

Business Expenses

Personally, I’ve found it useful to track some items separately, such as utilities and food (groceries vs. dining out), but then tracking all medical expenses together in one category I call “Health”.

Play around with this list of categories and see what works best for you and your family.

Remember that the best method is the one you’ll actually stick to. As far as actually tracking your expenses goes, the same applies for any app you may use.

There’s apps like Mint and Spending Tracker that will work well to track your spending.

One of my favorite apps to track my spending is called Empower. I like that it not only lets you track your spending by category, but you can also set separate budgets for stores, like Amazon, for example.

Empower is one of the fastest-growing personal finance apps in the US, with 4.7 stars in the Apple app store and over 650,000 downloads to date.

It features painless budgeting, spend tracking and more. Get started with Empower today to have a host of personal finance tools in the palm of your hand!

Whichever app you choose, find one that works well for you, and use it consistently!

Final Thoughts

The ultimate goal of creating categories for your budget is to have meaningful information that will help you make decisions about your spending, without getting bogged down with unnecessary data.

This way, your budget will be much more effective, and you’ll be more likely to stick to it!

What about you? Do you use some budget categories I didn’t include on this list? Share with us in the comments below!

If you found this post helpful, please share it!