How to Pay Off Debt Fast According to Your Personality

We’re all different, even when it comes to paying off debt. Here’s how to pay off debt fast according to your personality.

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

When it comes to paying off debt, there’s several methods you can employ.

But which one will help you the most?

In this post, we’ll explore which debt payoff method may work better for your particular situation, depending on your personality!

Common Methods to Pay off Debt

In the past several decades, there’s been much arguing about which debt payoff method is the best.

Thankfully, there’s an app for that!

The Debt Pay Off App does the math for you as to which method will help you become debt free faster. Download it for Android or iPhone to give it a try here!

The most common methods to pay off debt include:

The Debt Avalanche

This method focuses on paying off debt in order of their interest rate. By paying off the highest interest debt first, you save money on interest in the long run.

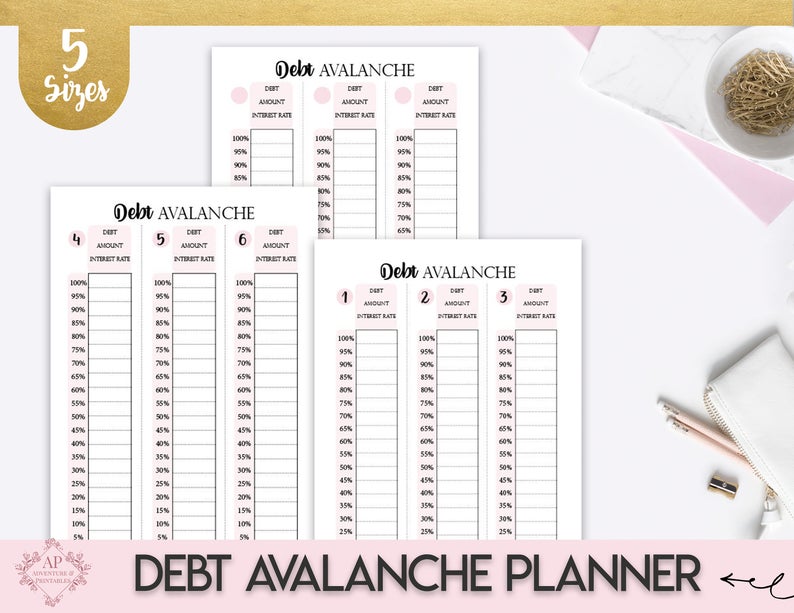

To keep track of your progress with the debt avalanche, I recommend this Planner.

A downside to this method is that it may take longer to see progress. For a complete explanation of the debt avalanche method, check it out here.

The Debt Snowball

The debt snowball method to pay off debt focuses on paying off debt according to each account’s balance. By tackling the smaller debts first, this method may help keep motivation up.

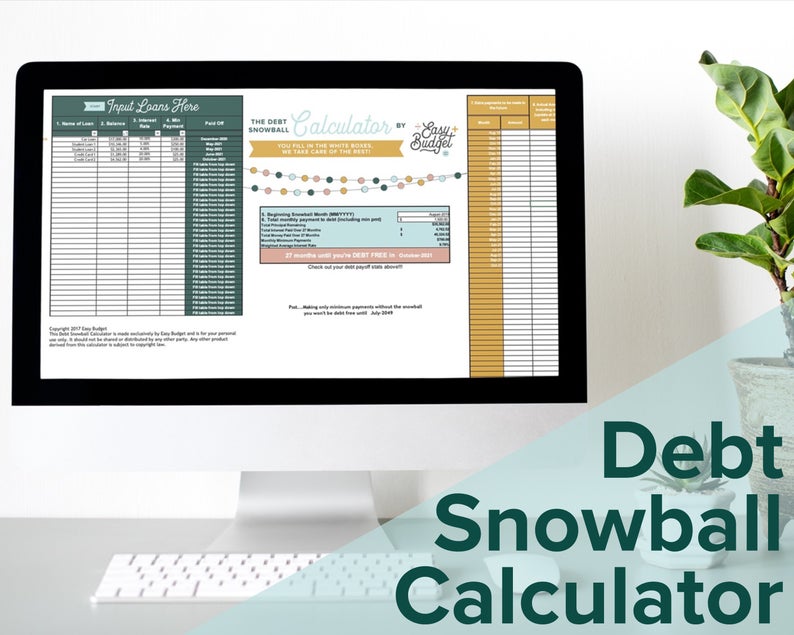

The easiest way to figure out which account to tackle first is to use a Debt Snowball Calculator.

If you’re OK with excel, this version is a great resource:

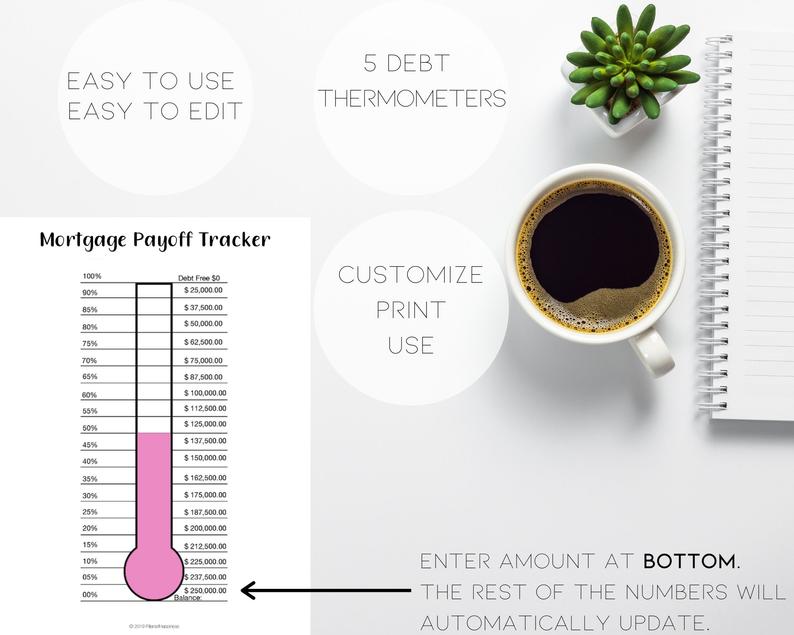

If you prefer to keep track of your payments by hand, I recommend using a debt thermometer printable and filling out weekly. I personally found doing this fun and motivating!

Another great resource is the Debt Snowball Budget Printable. It’s more in-depth than a thermometer tracker but can still be filled out by hand with ease!

Keep in mind that using the debt snowball may result in paying more interest while you pay off all your debt.

For a more in-depth analysis of the debt snowball method, check out this article.

The Debt Snowflake

This method focuses on making frequent payments towards your debts. Instead of making one large payment each month, this method advocates making as many small payments as possible throughout the month.

By doing this, you’ll pay less overall interest and you’re likely to see progress quickly.

Which Method is Right for Your Personality?

We’re all different, and this is true also when it comes to paying off debt.

The method that worked wonders for me may not help you at all.

So which method is right for you?

Setting math and technicalities aside, when it comes to paying off debt, the right method is the one that you’ll be able to follow and stick with, even through difficult times.

The method you choose will be completely irrelevant if you give up half way.

This is why, depending on your personality, one method may work best over another.

For the Analytical

If you’re really into numbers and figures, the debt avalanche method may work best for you. You can also use the debt snowflake to compliment it.

These two methods combined may work best for the analytical person who may get bogged down by thinking about all the money they’re wasting on interest if they choose to go with the debt snowball method instead.

For the Free Spirit

Budgeting may be difficult for the free spirited individual, which is why the debt snowflake method would be more advisable in this case.

This method allows more flexibility and requires less planning.

By removing the pressure of having to come up with a large payment each month, free spirits may actually thrive with the debt snowflake method.

For Type A Personalities

Type A personalities tend to be impatient. For this reason, the debt snowball method is recommended for those with this type of personality.

Going with a method that may make more mathematical sense, but takes longer, may result in feelings of discouragement.

Ultimately, this may lead to these personalities giving up on their debt repayment plans altogether.

If you’re a Type A personality, look for those small wins that the debt snowball method provides early on.

A quick sense of accomplishment may be just what you need to keep you motivated all the way through!

For Type B Personalities

Type B personalities are characterized by being more flexible and generally more laid back. For these individuals, any method could work well.

However, the debt snowflake method, which allows for a less rigid schedule and less planning, may work best.

Related Posts

The Debt Avalanche Method Explained in 4 Easy Steps

Debt Snowball Method: Does It Really Work?

5 Insider Secrets to Cut Your Debt in Half

Take Control of Your Debt with the Debt Snowflake Method

For the Extrovert

For extroverted personalities, any method may work well. However, aside from choosing a debt repayment method, other ways for extroverts to tackle their debt by playing on their personalities include:

- Surrounding themselves with supportive people

- Negotiating their debt with their creditors

Generally speaking, extroverted personalities will have no problem approaching their creditors to negotiate a payment plan or other payment arrangements.

Play on your strengths and use them to your advantage!

For the Introvert

Introverts tend to enjoy solitude. However, while you’re paying off debt, isolation is not your friend.

If you consider yourself an introvert, any debt repayment method can work well. But I’d like to emphasize the importance of a support network.

If face-to-face interactions are not your thing, then look for online forums or communities to cheer you on while you’re going through your debt payoff journey.

As an introvert myself, paying off debt took me out of my comfort zone on many occasions. Although this may have felt uncomfortable at the time, it helped me grow as a person.

Embrace change and challenges, and push yourself a little further each day!

If you’d like to learn more about how I paid off over $50K worth of debt while living on one income, be sure to check out my Quick Start Guide to Paying off Debt. In this short eBook, I’ll show you exactly how you too, can become debt free once and for all!

Paying off debt is rarely an easy feat, which is why it’s important that you find a method that works well for you. It may take some trial and error.

When I first started paying off my debt, I started using the debt avalanche method. However, I switched to the debt snowball a while later.

Don’t be afraid to play around with each method. Once you find what works best for you and your particular situation, stick with it until you’re debt free!

Which debt repayment methods have you used? Do you have a favorite? Share with us in the comments below!