4 Crucial Mindset Strategies to Become Debt Free

Have you tried to become debt free but found yourself making little or no progress at all? Find out what’s been keeping you from becoming debt free – and how to fix it!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

Quick story…

In my early twenties, I had no idea about how money worked.

I made a ton of pretty bad financial decisions.

My credit score was terrible.

I racked up my credit cards, I borrowed more than I could afford, and I had a habit of not paying back any of what I owed.

In fact, I dreaded going to work because I didn’t want to face the co-worker who lent me $40 I couldn’t pay.

I was living large… until my debt caught up to me.

The creditors wouldn’t stop calling. The bills would keep on coming. I didn’t know how to get myself out of that mess.

It even got to the point that I was paying for rent with the credit card!

It took several years for me to finally get it together and become debt free once and for all.

Once I figured out what was holding me back, and how to get past each of those obstacles, I was able to pay off over $50K of debt.

Not only that, I also build up a significant amount in savings in a few short years.

If you’d like replicate the steps I took to become debt free, download my Free Guide Here!

Today I want to share with you the 4 simple mindsets that I absolutely had to change before I could become debt free, and how you can implement them in your life as well.

Let’s get started!

“Change Your Mind, Change Your Life”

Have you ever heard that saying? I had heard many times before that all change begins in our mind.

When we start looking at a certain problem from a different angle, a different perspective, we begin to see solutions we hadn’t seen before.

So I took this advice to heart and I applied it to my debt situation.

I asked myself what had been holding me back.

After some self-reflection, I developed a plan to take down any obstacle that was keeping me from being debt free.

Here’s the 4 mindsets I realized I needed to change in order to succeed:

It’s Not My Fault

One of the main obstacles I found to paying off my debt, was that I felt that my situation wasn’t entirely my fault.

You see, I didn’t incur all that debt on my own.

Rather, it was the result of years of being married to a spender with bad credit.

We bought many of his things under my name.

Unfortunately, when we got divorced, I was ordered by the court to pay for all of it.

I felt it wasn’t fair.

I blamed my lawyer, my ex, the court – I probably would have blamed the dog if I could have.

The problem was that this mindset kept me bound – to anger, disappointment, envy and bitterness.

None of these feelings are conducive to productive change!

It wasn’t until I let go and stopped trying to get justice that I started to make progress.

Maybe your situation is similar to mine. Perhaps for you, it wasn’t a divorce.

For you, it could have been a health condition, or the loss of a job.

Whatever it may be, I’d like to encourage you to take a deep breath. Take some time to accept your current situation as yours and yours alone.

One tool that really helped me get back on track was Dave Ramsey’s book, the Total Money Makeover.

In this book, Dave shares simple, but effective principles, that help you come to terms with your current debt situation and move forward from there.

When you do this, you empower yourself to make changes, instead of waiting for someone else to correct the situation for you.

Let the past be the past.

Not only will this help you in your finances, but it is also emotionally healthy!

Related Posts:

5 Insider Secrets to Cut Your Debt in Half

How to Get Out of Debt by Changing this One Simple Habit

3 Quick Strategies to Achieve Your Financial Goals

It’s Too Difficult

Another biggie that holds many people back, is that becoming debt free may seem unattainable.

When you’re making minimum wage and owe thousands in debt, it may seem like there’s no possible way you could pull it off.

If this is your situation, let me encourage you:

No matter how hard it seems, you will find a way to become debt free!

I know this because I’ve been there.

Even if you can only take small steps, keep moving in the right direction!

When I started my debt payoff journey, I was a single mom to a young son.

I had no family in the area, and I was making just over $20K a year.

I was in a constant debt cycle.

Paying for this month’s expenses with credit only to find that I didn’t have money the following month for that month’s expenses or to pay back last month’s purchases.

It was overwhelming.

However, once I started thinking about all the other difficult situations I had already overcome in my life, I started to believe I could do this as well.

I recommend that you visualize where you want to be.

Allow details into that picture – what will you be doing once you’re debt free? Where will you be going? Who will be there with you?

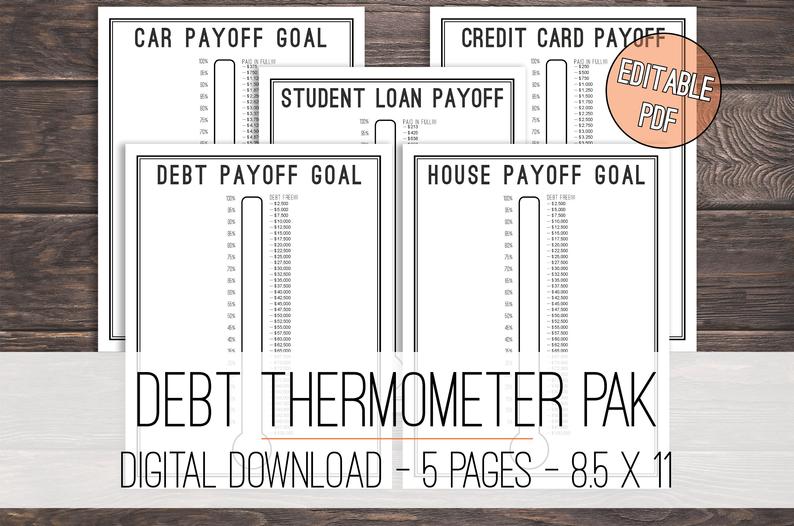

Aside from visualizing your goals, a little organization can go a long way to help you see the finish line.

Apps like the Debt Pay Off app help you do just that.

It provides you with a plan to pay your debt that best fits your situation, as well as with an estimated Debt Free Date!

Download this amazing tool for Android or iPhone here.

If you prefer to write things out, you can use a Debt Thermometer Tracker. I placed mine on the fridge and I found it really fun to fill it in each week.

You can get yours here:

When you have a clear picture in your head of not only what your goal is, but everything else it represents, it’s easier to stay on course overall.

Even if some days are a complete deviation from your plan.

I’m the Only One in This Situation

One of the mindsets that held me back for a long time was feeling ashamed of the mess I created for myself.

After all, it was the sum of my decisions that caused me to be broke and drowning in debt.

I felt like nobody would understand how I got there so I couldn’t ask for help.

Holding on to this kind of mentality creates isolation and perpetuates shame.

It also prevents us from seeking out accountability, which is a very important element if you want to succeed at paying off debt, losing weight, or any other life goal you may have.

If that’s you, let me assure you that you are not alone.

According to credit.com, 80% of Americans are in debt.

If you’re in debt, congratulations! You’re just like 8 out of 10 of your neighbors!

Know that you don’t have to go through this journey alone.

Find a good friend (or two) that will be able to encourage you when the going gets tough, and who can keep you accountable to your goals.

If you’re an introvert like me, find an online community that can support you in your journey.

Finding encouraging and motivational individuals, on or offline, can also keep you motivated.

One of my favorite motivational speakers is Nick Vujicic. He’s really funny!

I see him live every time he’s in my area. I’m always amazed at how much joy he has even though he was born without arms or legs.

Here’s a short video of his life. Watch his face at the end… It’s priceless!

Lastly, remember to check out my blog often for tips and resources that will help you stay on track!

It’s Too Confusing

When I started trying to get out of debt, I ran into a problem.

It’s not that I couldn’t find information on how to get out of debt, it’s that I found too much.

I was paralyzed by information overload.

I would spend hours upon hours reading columns, blogs and success stories, trying to find what would work for me.

Often I would get conflicting advice and I didn’t know which one was right so I followed neither.

Finally, I decided to take the first step. Even if it wasn’t the best one, or the one that would save me the most money in the end.

No matter. I just needed to get going!

Once I took that first step though, I started to get momentum.

After that, I didn’t stop until I was all done!

If you also feel confused by all the information out there, I recommend that you pick one thing to tackle at a time.

Maybe choose one debt and throw all your energy into it until you pay it off, then move on to the next one.

If it’s your credit that you want to fix but don’t know where to start, choose one thing to focus on.

Maybe it’s a collection account that’s been bugging you.

Pay it off or settle it, then move on to the next thing you can fix.

Don’t be a victim of paralysis by analysis!

The first step is often the hardest one.

Once you take it though, you’ll wonder why you didn’t do it sooner.

Before you begin your debt payoff journey, take a step back and take inventory of your situation and your mindset.

Take note of how you feel about your debt and any erroneous thinking that may be holding you back.

I covered here four of the most common mindsets that often delay people in achieving their financial goals and freedom.

However, each situation – your situation, is unique.

As you begin to identify which thoughts have been preventing you from becoming debt free, and as you make a plan to combat them, you will be one step closer to being debt free for life!

Do you have a debt payoff success story? Share it with us in the comments below!