3 Tips to Get Out of Debt that Guarantee Success

I’ve been there. Waking up in the middle of the night thinking about how can I get out of debt and all the money I owe.

Truth is, debt can be really overwhelming, but with the right technique, you can conquer your debt! Follow these simple tips to get out of debt for good.

This post contains affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

I know what it’s like to dread the collections calls. To wake up in the middle of the night, or not be able to fall asleep, thinking about all the money I owe.

Dreading going into work because I know my co-worker will ask me to pay him back the money he lent me a month ago.

There is Hope to Get Out of Debt

Debt can make you feel like you’re drowning sometimes, and it may seem like there’s no way out from it.

If that’s how you’re feeling, let me tell you that there’s hope!

Several years ago, I decided I had to do something about my finances.

I was sick and tired of that drowning feeling, of that void in my stomach.

It just wasn’t acceptable anymore!

A single mom at the time, I was living on one income and sometimes struggling to make ends meet.

It took me several years to be debt-free, but if I can do it, I know that you can do it too!

Here’s the three tips I used to pay off my debt years ago (For a more in-depth step by step guide, sign up here to receive my free Quick Start Guide on Paying off Debt):

1. Have a Focal Point

Paying off debt can feel discouraging at times.

It may feel like you’re not making any progress at all. You may feel like giving up.

This is why it’s important to have a focal point.

You want to have that light at the end of the tunnel that you can focus on.

For me, my focus, my drive, was to provide a better future for this little boy:

I didn’t want to leave a legacy of debt for him to grow up in, or for him to grow up believing that debt was a normal part of life.

I wanted to provide for his financial stability, but debt wasn’t allowing me to.

Debt was keeping me from living the life I wanted to live, so I made that my focal point.

2. Picture the Light at the End of the Tunnel

At the beginning of my debt payoff journey, I thought about what I wanted my life to be like without debt.

What would it look like, feel like, to be debt free? I wrote it down in a piece of paper and I taped it to my wall.

Every day, that piece of paper gave me focus, and it gave me determination to do whatever I could to get out of debt.

On those days that I felt totally discouraged, I looked at that paper. I knew setbacks would be part of the story, but the sentences I wrote on that paper gave me the strength to keep moving forward.

Visual aids are a great help for those days.

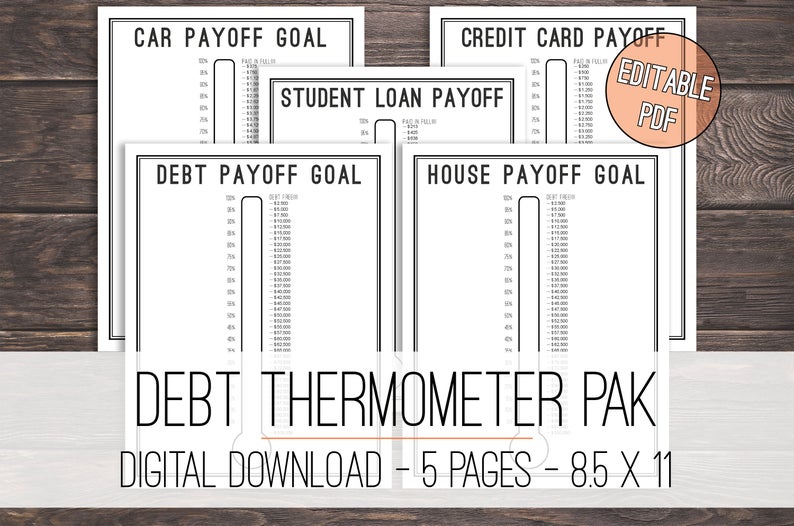

Especially if they’re fun and keep things light! That’s why I really like the Debt Thermometer Tracker.

Graphics and creative material belong to the original author

If you keep it in a visible place and fill it in regularly, it will keep you motivated to reach what you’ve pictured in your mind.

So what will your focal point be? What will financial freedom feel like?

Can you picture it?

Do you want to provide a better financial future for your children? What about traveling without a care in the world? Or finally being able to quit that toxic job without having to worry about money?

Please share your motivation in the comments below!

Whatever your reason is, write it down, keep it visible, and remember it when things get rough.

3. Be Aggressive

One of the reasons why people stay in debt for decades is because of the accumulated interest.

Have you ever looked at your credit card statement where it lists how long it will take you to pay off the balance if you just stick to the minimum monthly payment?

It’s outrageous.

If you want to pay off your debt, you have to be aggressive with it.

Otherwise, whatever progress you make will be wiped out the next month with the interest alone.

So what does it mean to be aggressive?

Attack your debt from every possible angle.

If possible, try to transfer balances from high interest cards to others with lower interest.

Request a reduction in the cards’ interest rate.

Get a personal loan from Lending Tree with a lower interest than your existing cards and use it to pay off as many balances as you can.

Throw every single penny you can at your debt for as long as you can.

In fact, here’s some ways I saved money so I could make higher payments on my debt:

- I cut down expenses to the bare minimum. I shared a one bedroom apartment with my son for three years. Even though I could afford a two bedroom apartment, that would mean I’d be paying more for rent, and I’d have less money for my debt.

- Coupons were my best friend; I got every discount I could get

and stuck to generic brands to cut down my grocery expenses - I also shopped at Aldi and other discounted stores

It may be annoying, but it’s just for a little while. During that time period, I thought about how I spent every. single. penny.

- I was very careful with how I used my electricity and I didn’t have cable or internet. Instead, I used the local library to rent movies and TV shows and I went to a friend’s house when I really needed the internet for something

- I stuck to free or low-cost entertainment. My favorite? Movies at the park sponsored by my local government. I also took advantage of discount days at the local attractions and kept things simple with arts and craft at home.

Related Content:

11 Smart Hacks to Slash Your Grocery Bill in Half

5 Ideas to Make Some Side Cash Today

16 Ways to Save Loads of Money and Still Have Fun

- I sold whatever I could sell to have extra money to pay off my debt. This included old books, clothes, furniture and household items. You could have said I was embracing minimalism, but that wasn’t a thing back then that I know of lol.

- I started a couple of side jobs such as babysitting and dog walking. I also got a couple of gigs as a personal assistant running errands at my lunch time for a fee.

When you do those kinds of things and become aggressive with your debt, not only can you see progress much faster, but you also end up saving thousands of dollars on interest charges.

What will you do? How will you be aggressive with your debt?

List out at least five to ten options that you can think of and see how feasible it would be to execute them.

Use the Right Method for You to Get Out of Debt

We’re all different from each other. We have different motivators and we learn differently.

I can’t tell you to use X method to pay off your debt just because that’s what worked for me.

Instead, what I can suggest is that you find a method that works well with your personality and your goals, and stick with it.

Related Content:

How to Pay Off Debt Fast According to Your Personality

Debt Snowball Method: Does it Really Work?

The Debt Avalanche Method Explained in 4 Easy Steps

What worked best for me was using the debt snowball method, where you attack your debts in order of their account balance, starting with the smallest one.

By doing this, I was motivated by the quick results I got at the beginning of my debt payoff journey and was able to keep going even when I felt discouraged.

What will work for you?

It may take some trial and error, but once you find something that works well for you and your specific situation, stick with it until you reach your debt payoff goal!

That’s it guys!

These three simple things helped me pay off my debt and become debt free for good! For a more in-depth step by step guide, sign up here to receive my free Quick Start Guide on Paying off Debt.

If you found this post helpful, please share it!