Make The Debt Avalanche Method Work in 4 Easy Steps

The debt avalanche method is a common choice to pay off debt. In this post, I break down what this method is all about and how to make it work for you!

This post may contain affiliate links, which means I may earn a small commission at no extra cost to you. For more information, please see my disclosure here. Thank you for your support!

If you’ve ever heard the term “debt avalanche” and wondered what that’s all about, this post is for you!

A debt avalanche is a popular method of paying off debt.

It focuses on paying off the debts that carry the highest interest rates first.

The theory behind the debt avalanche method is that by cancelling the debts with the highest interest first, you’ll end up saving money on interest in the process.

Let’s break down exactly how this method works:

Step 1: Arrange Your Debts

The first step to start a debt avalanche is to arrange all your debts in one place in order of their interest. Arrange them from highest to lowest.

If you’re not sure what the interest rates are on each account, a good place to start is the monthly statements.

If the interest rate is not readily available on the account statements, or if you don’t have access to those documents, you may want to call the creditor directly and ask.

Step 2: Make Extra Payments

Once you have determined which of your debts carries the highest interest rate, “find” extra money and allocate it all to that one debt.

How do you find extra money? I’m sorry to tell you that there’s no magic formula here.

You either increase your income or reduce your expenses, that’s it.

To make extra money, there’s a ton of things you can try.

You could babysit on the weekend, or find a fully remote part-time job through FlexJobs.

You can also try selling stuff you no longer need using apps like OfferUp.

On a totally unrelated side note, my son once fractured his ankle. He had to use a wheelchair for a month.

Once he was done with it, the wheelchair just sat in the trunk of my car taking up valuable space.

I was desperate to get rid of it, so I listed it on OfferUp.

I didn’t think there would be much of a market for such a thing. However, I sold it within two weeks of listing it for only $20 less than what I originally paid for it!

Moral of the story?

Think outside the box. Get creative and find ways to bring in extra money.

For ideas on how to cut back your expenses, check out the Save Money section of the blog.

There, you’ll find money-saving ideas on everything from grocery shopping to family vacations.

Related Posts

5 Ideas to Make Some Side Cash Today

The Debt Avalanche Method Explained (Infographic)

How to Pay Off Debt According to Your Personality

Step 3: Work Your Way Down The List

Once that first bill has been paid off, repeat the process with the second highest interest debt. Throw any additional money you can to it until it’s completely paid off.

Once that debt is paid off, move on to the next one and so on and so forth.

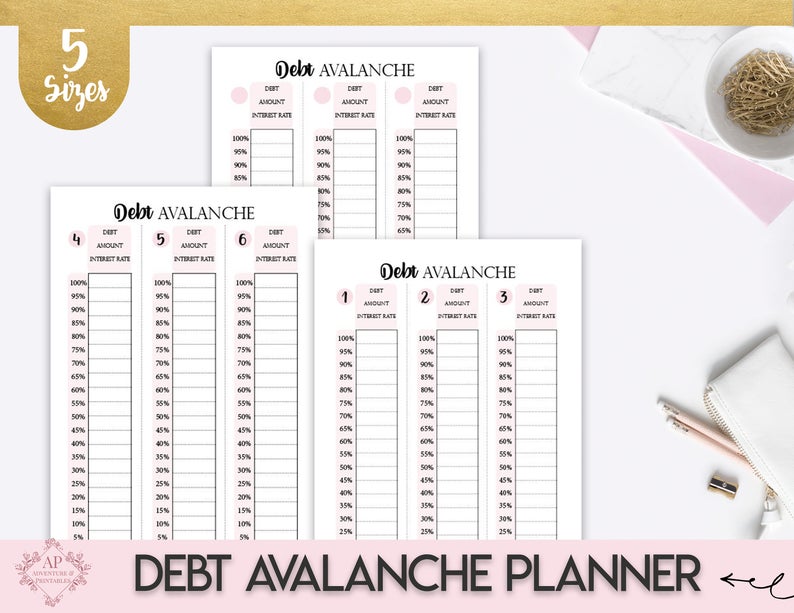

When I was going through my process of paying off debt, I found it helpful to “see” my debts and the progress I was making towards them.

A great tool I found really helpful for this was a Debt Avalanche Planner. It helps you visualize your debts and track your progress easily. You can get yours here!

Step 4: Enjoy Being Debt Free!

That’s it! There’s no big secret to this method.

The last step to the debt avalanche, is to enjoy being debt free! Enjoy knowing that you’ve paid the least possible amount on interest!

Who Is This Method For?

Now, let’s discuss for a moment who this method works well for.

This is important!

The method that’s gonna work for you is the one that you’ll be able to stick with.

So who is the debt avalanche for?

This method to pay off debt works better for those who are very analytical. Also for those who thrive in paying the least amount of interest, and those who are patient.

Why?

Because when you use the debt avalanche, it can take a while to see any real progress.

Imagine for example that the debt that carries the highest interest rate has a balance of $10,000.

If you’re gonna attack this debt first, it’s gonna be a while until you can pay this off and move on to the next one.

How Do You Calculate Avalanche Debt?

Many people get stuck on which debts to include. Say you have a mortgage and a home equity line of credit on your home. Should you include those in your debt avalanche calculation?

What about a car loan that has a higher interest than all your credit cards?

What I recommend is to leave out the really huge debts like a mortgage from your calculation at first.

Why?

Because mortgages often carry lower interest rates than credit cards, lines of credit and other loans. So in theory, you shouldn’t focus on those debts at the beginning of your avalanche anyway.

By leaving off your mortgage you can first focus on the debts that often trip people up with outrageous interest rates.

Once you’ve made significant progress with those or even paid them off completely, then focus on the larger debts you left off in the beginning.

Alternatives to the Debt Avalanche Method

An alternative to this method would be the debt snowball.

This method focuses on paying off debt in order of account balance, starting with the smallest. It works on the premise that getting a sense of victory early on will keep you motivated.

To learn more about how the debt snowball method works and who it’s best for, you can check out this article where I explain exactly how follow it.

You can also check out this infographic that explains it!

A really simple way to find out which method would work best for you is to use Jackie Beck’s Debt Payoff App.

With a few clicks and some data entry, this app will compare the two methods for you. It will show you at a glance how long each different method will take you to become debt free and how much interest you’ll end up paying.

It really takes the guesswork out of figuring out which method you should use, so I highly recommend it. You can download it for Android or iOS systems.

If you want a step by step instruction on how to get out of debt, be sure to grab my free Quick Start Guide to Paying Off Debt.

In it, I walk you, step by step, through how I was able to pay off over $50K of debt on one income, and how you can become debt free as well!

The debt avalanche method is a popular method to pay off debt.

It can save you a ton of money on interest in the long run, but it can take some time before you see any results.

Remember that when choosing a method to pay off debt, the best method is the one you’ll be able to stick with!

Have you tried using the debt avalanche method or another method to pay off debt? Share your experience in the comments below!